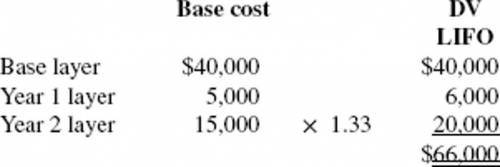

Brock Co. adopted the dollar-value LIFO inventory method as of January 1, Year 6. A single inventory pool and an internally computed price index are used to compute Brock’s LIFO inventory layers. Information about Brock’s dollar-value inventory follows: Inventory At Base- At Current- At Dollar- Date Year Cost Year Cost Value LIFO 1/1/Yr 6 $40,000 $40,000 $40,000 Year 6 layer 5,000 14,000 6,000 12/31/Yr 6 $45,000 $54,000 $46,000 Year 7 layer 15,000 26,000 ? 12/31/Yr 7 $60,000 $80,000 ? What was Brock’s dollar-value LIFO inventory at December 31, Year 7?

Answers: 2

Another question on Business

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 19:40

Adistinguishing feature of ecological economics is the concept of cost-benefit analysis steady-state economies that, like natural systems, neither grow nor shrink environmental damage and also environmental benefits are external greenwashing to increase public acceptance of products the only healthy economy is one that is growing

Answers: 1

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 22.06.2019 21:00

On july 2, year 4, wynn, inc., purchased as a short-term investment a $1 million face-value kean co. 8% bond for $910,000 plus accrued interest to yield 10%. the bonds mature on january 1, year 11, and pay interest annually on january 1. on december 31, year 4, the bonds had a fair value of $945,000. on february 13, year 5, wynn sold the bonds for $920,000. in its december 31, year 4, balance sheet, what amount should wynn report for the bond if it is classified as an available-for-sale security?

Answers: 3

You know the right answer?

Brock Co. adopted the dollar-value LIFO inventory method as of January 1, Year 6. A single inventory...

Questions

Biology, 07.06.2021 23:20

Social Studies, 07.06.2021 23:20

Chemistry, 07.06.2021 23:20

English, 07.06.2021 23:20

Social Studies, 07.06.2021 23:20

Mathematics, 07.06.2021 23:20

History, 07.06.2021 23:20

Mathematics, 07.06.2021 23:20

Mathematics, 07.06.2021 23:20