Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 &...

Business, 20.03.2020 09:11 lisacarter0804

Suppose we are planning to buy a company with the following forecasts:

Year 1 2 3 & afterwards

FCF $5 million $ 5.5 million 3% constant growth rate

Debt level $50 million $35 million Constant debt to equity ratio. Capital will be 50% debt and 50% equity, wd = ws = 0.5.

The cost of debt is 5%

The cost of equity is 20%

The tax rate is 40%

The company has 15 million shares outstanding

The current stock price is $2.05

The company is currently holding no financial assets.

The company has $3,000,000 in debt.

WACC, the cost of capital, is equal to 11.5%

RSU, the cost of unlevered equity, is equal to 12.5%

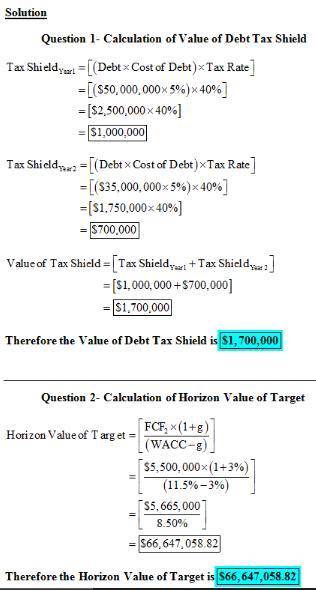

a. Calculate the value of the debt tax shield.

b. Calculate the horizon value of the target.

Answers: 3

Another question on Business

Business, 21.06.2019 22:20

Steele bicycle manufacturing company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. steele produces and sells only 10,000 bikes each year. due to the low volume of activity, steele is unable to obtain the economies of scale that larger producers achieve. for example, steele could buy the handlebars for $31 each: they cost $34 each to make. the following is a detailed breakdown of current production costs: after seeing these figures, steele's president remarked that it would be foolish for the company to continue to produce the handlebars at $34 each when it can buy them for $31 each. calculate the total relevant cost. do you agree with the president's conclusion?

Answers: 1

Business, 22.06.2019 00:30

Find the interest rate for a $4000 deposit accumulating to $5234.58, compounded quarterly for 9 years

Answers: 1

Business, 22.06.2019 13:10

The textbook defines ethics as “the principles of conduct governing an individual or a group,” and specifically as the standards one uses to decide what their conduct should be. to what extent do you believe that what happened at bp (british petrolium) is as much a breakdown in the company’s ethical systems as it is in its safety systems, and how would you defend your conclusion?

Answers: 2

Business, 22.06.2019 16:40

Match the situations that will develop one's personality and those that won't peter is surrounded by friends who are always encouraging him jonathan always watches television when he wants to take a break from his books libby sets small targets for herself and strives to achieve them. the smiths indulge in an animated discussion on varied topics every evening after dinner. brook loves junk food and exercises once in a while. develops your personality develops doesn't develop your personality

Answers: 2

You know the right answer?

Questions

English, 17.12.2019 23:31

Social Studies, 17.12.2019 23:31

English, 17.12.2019 23:31

Mathematics, 17.12.2019 23:31

English, 17.12.2019 23:31

Mathematics, 17.12.2019 23:31

Biology, 17.12.2019 23:31

Mathematics, 17.12.2019 23:31