Business, 20.03.2020 10:27 hgtfdtdytrytdy748

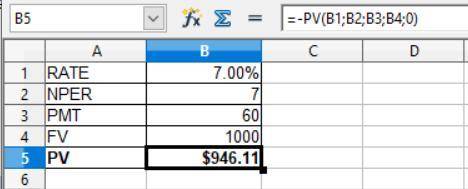

You buy an eight-year bond that has a 6% current yield and a 6% coupon (paid annually). In one year, promised yields to maturity have risen to 7%. What is your holding-period return

Answers: 2

Another question on Business

Business, 22.06.2019 03:20

The treasurer for pittsburgh iron works wishes to use financial futures to hedge her interest rate exposure. she will sell five treasury futures contracts at $139,000 per contract. it is july and the contracts must be closed out in december of this year. long-term interest rates are currently 7.30 percent. if they increase to 9.50 percent, assume the value of the contracts will go down by 20 percent. also if interest rates do increase by 2.2 percent, assume the firm will have additional interest expense on its business loans and other commitments of $149,000. this expense, of course, will be separate from the futures contracts. a. what will be the profit or loss on the futures contract if interest rates increase to 9.50 percent by december when the contract is closed out

Answers: 1

Business, 22.06.2019 04:50

Problem 9-5. net present value and taxes [lo 1, 2] penguin productions is evaluating a film project. the president of penguin estimates that the film will cost $20,000,000 to produce. in its first year, the film is expected to generate $16,500,000 in net revenue, after which the film will be released to video. video is expected to generate $10,000,000 in net revenue in its first year, $2,500,000 in its second year, and $1,000,000 in its third year. for tax purposes, amortization of the cost of the film will be $12,000,000 in year 1 and $8,000,000 in year 2. the company’s tax rate is 35 percent, and the company requires a 12 percent rate of return on its films. required what is the net present value of the film project? to simplify, assume that all outlays to produce the film occur at time 0. should the company produce the film?

Answers: 2

Business, 22.06.2019 05:30

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 08:00

In addition to using the icons to adjust page margins, a user can also use

Answers: 1

You know the right answer?

You buy an eight-year bond that has a 6% current yield and a 6% coupon (paid annually). In one year,...

Questions

Arts, 06.10.2019 09:02

English, 06.10.2019 09:02

Biology, 06.10.2019 09:02

History, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02

Physics, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02

History, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02

History, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02

Chemistry, 06.10.2019 09:02

History, 06.10.2019 09:02

Mathematics, 06.10.2019 09:02