Business, 21.03.2020 04:06 crystrow9p6qc7n

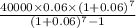

You plan to borrow $40,000 at a 6% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2

Answers: 2

Another question on Business

Business, 22.06.2019 03:10

On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. journalize the first interest payment and the amortization of the related bond premium. round to the nearest dollar. if an amount box does not require an entry, leave it blank.

Answers: 3

Business, 22.06.2019 15:40

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

Business, 22.06.2019 23:00

Even sole proprietors should have at least how many computers? 1 2 3 4

Answers: 1

You know the right answer?

You plan to borrow $40,000 at a 6% annual interest rate. The terms require you to amortize the loan...

Questions

Mathematics, 07.04.2020 21:47

Mathematics, 07.04.2020 21:47

Mathematics, 07.04.2020 21:47

Mathematics, 07.04.2020 21:47

Physics, 07.04.2020 21:47

Chemistry, 07.04.2020 21:47

Mathematics, 07.04.2020 21:47

................1

................1