Business, 23.03.2020 17:29 joseaguilaroux4zh

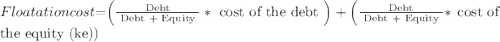

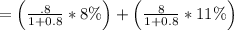

Suppose your company needs $18 million to build a new assembly line. Your target debt-equity ratio is .8. The flotation cost for new equity is 11 percent, but the flotation cost for debt is only 8 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a.What is your company’s weighted average flotation cost, assuming all equity is raised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole dollar amount, e. g., 1,234,5667.)

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

An investment counselor calls with a hot stock tip. he believes that if the economy remains strong, the investment will result in a profit of $40 comma 00040,000. if the economy grows at a moderate pace, the investment will result in a profit of $10 comma 00010,000. however, if the economy goes into recession, the investment will result in a loss of $40 comma 00040,000. you contact an economist who believes there is a 2020% probability the economy will remain strong, a 7070% probability the economy will grow at a moderate pace, and a 1010% probability the economy will slip into recession. what is the expected profit from this investment?

Answers: 2

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 18:40

Under t, the point (0,2) gets mapped to (3,0). t-1 (x,y) →

Answers: 3

Business, 22.06.2019 21:00

In a transportation minimization problem, the negative improvement index associated with a cell indicates that reallocating units to that cell would lower costs.truefalse

Answers: 1

You know the right answer?

Suppose your company needs $18 million to build a new assembly line. Your target debt-equity ratio i...

Questions

Mathematics, 15.10.2019 06:10

History, 15.10.2019 06:10

Mathematics, 15.10.2019 06:10

History, 15.10.2019 06:10

History, 15.10.2019 06:10

Mathematics, 15.10.2019 06:10

Mathematics, 15.10.2019 06:10

Mathematics, 15.10.2019 06:10

Biology, 15.10.2019 06:10