Business, 23.03.2020 17:49 ciaotaylor

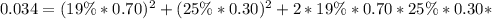

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 19%, while stock B has a standard deviation of return of 25%. Stock A comprises 70% of the portfolio, while stock B comprises 30% of the portfolio. If the variance of return on the portfolio is 0.034, the correlation coefficient between the returns on A and B is .

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Abond is issued for less than its face value. which statement most likely would explain why? a. the bond's contract rate is higher than the market rate at the time of the issue. b. the bond's contract rate is the same as the market rate at the time of the issue. c. the bond's contract rate is lower than the market rate at the time of the issue. d. the bond isn't secured by specific assets of the corporation.

Answers: 1

Business, 22.06.2019 00:00

If his parents cannot alex with college, and two of his scholarships will be awarded to other students if he does not accept them immediately, which is the best option for him?

Answers: 1

Business, 22.06.2019 19:00

Which of the following would cause a shift to the right of the supply curve for gasoline? i. a large increase in the price of public transportation. ii. a large decrease in the price of automobiles. iii. a large reduction in the costs of producing gasoline

Answers: 1

You know the right answer?

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 19%, w...

Questions

Mathematics, 03.04.2020 17:05

Chemistry, 03.04.2020 17:05

History, 03.04.2020 17:06

History, 03.04.2020 17:07

History, 03.04.2020 17:07

Correlation coefficent

Correlation coefficent