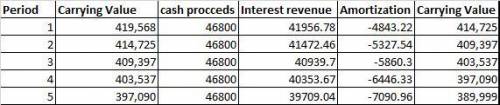

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,567.77. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Monty Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category. Prepare the journal entry at the date of the bond purchase. Prepare a bond amortization schedule. Prepare the journal entry to record the interest revenue and the amortization at December 31.

Answers: 2

Another question on Business

Business, 22.06.2019 00:30

What are six resources for you decide which type of business to start and how to start it?

Answers: 3

Business, 22.06.2019 11:30

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 12:40

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 22.06.2019 20:20

Why is it easier for new entrants to get involved in radical innovations when compared to incumbent firms? a. unlike incumbent firms, new entrants do not have to face the high entry barriers, initially. b. new entrants are embedded in an innovation ecosystem, while incumbent firms are not. c. unlike incumbent firms, new entrants do not have formal organizational structures and processes. d. incumbent firms do not have the advantages of network effects that new entrants have.

Answers: 2

You know the right answer?

On January 1, 2020, Monty Company purchased 12% bonds having a maturity value of $390,000, for $419,...

Questions

Spanish, 19.12.2020 02:00

History, 19.12.2020 02:00

Mathematics, 19.12.2020 02:00

Biology, 19.12.2020 02:00

Engineering, 19.12.2020 02:00

Biology, 19.12.2020 02:00

Mathematics, 19.12.2020 02:00

Chemistry, 19.12.2020 02:00

Spanish, 19.12.2020 02:00

Mathematics, 19.12.2020 02:00

![\left[\begin{array}{cccccc}#&$B.Carrying&$cash&$Interest&$Amortization&$E.Carrying\\1&419567.77&46800&41956.78&-4843.22&414724.55\\2&414724.55&46800&41472.46&-5327.54&409397.01\\3&409397.01&46800&40939.7&-5860.3&403536.71\\4&403536.71&46800&40353.67&-6446.33&397090.38\\5&397090.38&46800&39709.04&-7090.96&389999.42\\\end{array}\right]](/tpl/images/0559/5401/386bc.png)