Business, 24.03.2020 01:51 annamcveigh50

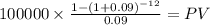

To raise operating funds, National Distribution Center sold its office building to an insurance company on January 1, 2018, for $800,000 and immediately leased the building back. The operating lease is for the final 12 years of the building's estimated 20-year remaining useful life. The building has a fair value of $800,000 and a book value of $650,000 (its original cost was $1 million). The rental payments of $100,000 are payable to the insurance company each December 31. The lease has an implicit rate of 9%.

Prepare the appropriate entries for National Distribution Center on:

1. January 1, 2019, to record the sale-leaseback

2. December 31, 2018, to record necessary adjustments

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

What is an example of a good stock to buy in a recession? a) cyclical stock b) defensive stock c) income stock d) bond

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 14:50

The following information is needed to reconcile the cash balance for gourmet catering services. * a deposit of $5,600 is in transit. * outstanding checks total $1,000. * the book balance is $6,400 at february 28, 2019. * the bookkeeper recorded a $1,800 check as $17,200 in payment of the current month's rent. * the bank balance at february 28, 2019 was $17,410. * a deposit of $400 was credited by the bank for $4,000. * a customer's check for $3,300 was returned for nonsufficient funds. * the bank service charge is $90. what was the adjusted book balance?

Answers: 1

Business, 22.06.2019 20:00

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it.g

Answers: 2

You know the right answer?

To raise operating funds, National Distribution Center sold its office building to an insurance comp...

Questions

Mathematics, 28.09.2021 20:30

Mathematics, 28.09.2021 20:30

History, 28.09.2021 20:30

Computers and Technology, 28.09.2021 20:30

Mathematics, 28.09.2021 20:30

Computers and Technology, 28.09.2021 20:30

Mathematics, 28.09.2021 20:30

Arts, 28.09.2021 20:30