$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Y...

Business, 24.03.2020 02:49 mmimay3501

$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Yield to Maturity

A 1 6.00%

B 2 7.50%

C 3 7.99%

D 4 8.49%

E 5 10.70%

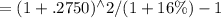

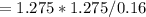

The expected 1-year interest rate 1 years from now should be

a. 6%

b. 7.5%

c. 9.02%

d. 10.70%

Answers: 3

Another question on Business

Business, 21.06.2019 20:40

Balances for each of the following accounts appear in an adjusted trial balance. identify each as an asset, liability, revenue, or expense. 1. accounts receivable 2. equipment 3. fees earned 4. insurance expense 5. prepaid advertising 6. prepaid rent 7. rent revenue 8. salary expense 9. salary payable 10. supplies 11. supplies expense 12. unearned rent

Answers: 3

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

Business, 23.06.2019 01:00

What is the average price for the cordless telephones (to 2 decimals)? $ b. what is the average talk time for the cordless telephones (to 3 decimals)? hours c. what percentage of the cordless telephones have a voice quality of excellent? % d. what percentage of the cordless telephones have a handset on the base?

Answers: 3

You know the right answer?

Questions

Chemistry, 06.12.2021 03:30

Mathematics, 06.12.2021 03:30

Chemistry, 06.12.2021 03:30

Mathematics, 06.12.2021 03:30

Advanced Placement (AP), 06.12.2021 03:30

Mathematics, 06.12.2021 03:30

Mathematics, 06.12.2021 03:30

English, 06.12.2021 03:30