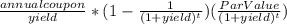

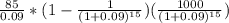

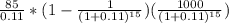

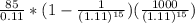

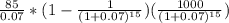

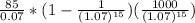

(Bond valuation relationships) Stanley, Inc. issues 15-year $1 comma 000 bonds that pay $85 annually. The market price for the bonds is $960. The market's required yield to maturity on a comparable-risk bond is 9 percent. a. What is the value of the bond to you? b. What happens to the value if the market's required yield to maturity on a comparable-risk bond (i) increases to 11 percent or (ii) decreases to 7 percent? c. Under which of the circumstances in part b should you purchase the bond? a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 9 percent?

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

When someone buys a fourth television for his or her house, what is the result? a. there's a decrease in the marginal utility of the television. b. the increase in demand brings leads to higher prices for televisions. c. the production of televisions becomes more efficient. d. there's a rise in the opportunity cost of buying other goods.

Answers: 2

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

Business, 22.06.2019 20:50

Which of the following is an example of a monetary policy? a. the government requires credit card companies to protect customers' privacy. b. the government restricts the amount of money that banks can lend. c. the government lowers taxes and increases spending. d. the government pays for repairing damage from a natural disaster.

Answers: 1

You know the right answer?

(Bond valuation relationships) Stanley, Inc. issues 15-year $1 comma 000 bonds that pay $85 annually...

Questions

History, 02.05.2021 01:30

Computers and Technology, 02.05.2021 01:30

Business, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30

History, 02.05.2021 01:30

Mathematics, 02.05.2021 01:30