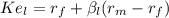

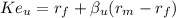

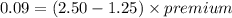

5) EverShine was an unlevered company with beta of 1.25. It decided to borrow money and buyback stock with the proceeds. Cost of equity capital went up by 9% after levering to a debt to value ratio of 0.5. Debt is risk free. Tax rate is zero. Depreciation level is $ 50 Million per year. EBIT is $ 875 Million per year. How much is the market risk premium

Answers: 2

Another question on Business

Business, 22.06.2019 05:10

Suppose that the free states of eldricia, a small nation, has consumption, investment, government purchases, imports, and exports as follows. consumption $140 investment $50 government purchases $45 imports $30 exports $15 calculate the free states of eldricia's gdp

Answers: 2

Business, 23.06.2019 06:10

Which of the following functions finds the highest value of selected inputs? a. high b. hvalue c. max

Answers: 3

Business, 23.06.2019 09:30

Which of the following economic behaviors causes scarcity? a limited supply and unlimited demand b limited supply and unlimited credit c limited supply and limited regulation d limited supply and limited incentives

Answers: 1

Business, 23.06.2019 13:20

Which type of tax is imposed on specific goods and services at the time of purchase? question 12 options: estate excise general sales value-added

Answers: 1

You know the right answer?

5) EverShine was an unlevered company with beta of 1.25. It decided to borrow money and buyback stoc...

Questions

English, 21.01.2021 20:40

History, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

History, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

Mathematics, 21.01.2021 20:40

English, 21.01.2021 20:40

English, 21.01.2021 20:40

![\beta_l = \beta_u \times [1 + (1 - t) \times \frac{D}{E} ]\\\beta_l = 1.25 \times [1 + (1 - 0) \times 1 ]\\\\\beta_l = 1.25 \times [1 + 1 ]\\\\\beta_l = 2.50](/tpl/images/0561/5384/59bd3.png)