Business, 24.03.2020 22:58 jakails3073

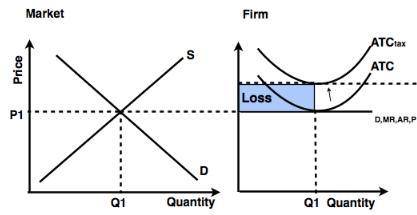

If a firm is currently in a short-run equilibrium earning a profit, what impact will a lump-sum tax have on its production decision? A. The firm will increase output but earn a lower profit. B. The firm will not change output and earn a higher profit. C. The firm will not change output but earn a lower profit. D. The firm will decrease output to earn a higher profit.

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

When selecting a savings account, you should look at the following factors except annual percentage yield (apy) fees minimum balance interest thresholds taxes paid on the interest variable interest rates

Answers: 1

Business, 22.06.2019 09:40

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a.standard deductionb.itemized deductionc.personal exemptiond.none of these. all of these are from agi deductions

Answers: 3

Business, 22.06.2019 17:30

You should do all of the following before a job interview except

Answers: 2

You know the right answer?

If a firm is currently in a short-run equilibrium earning a profit, what impact will a lump-sum tax...

Questions

Mathematics, 22.01.2022 22:20

Mathematics, 22.01.2022 22:20

Biology, 22.01.2022 22:20

Social Studies, 22.01.2022 22:30

English, 22.01.2022 22:30

Mathematics, 22.01.2022 22:30

Computers and Technology, 22.01.2022 22:30

Chemistry, 22.01.2022 22:30

Mathematics, 22.01.2022 22:30

Mathematics, 22.01.2022 22:30

Mathematics, 22.01.2022 22:30

Mathematics, 22.01.2022 22:30