Business, 24.03.2020 23:59 churchlady114p2met3

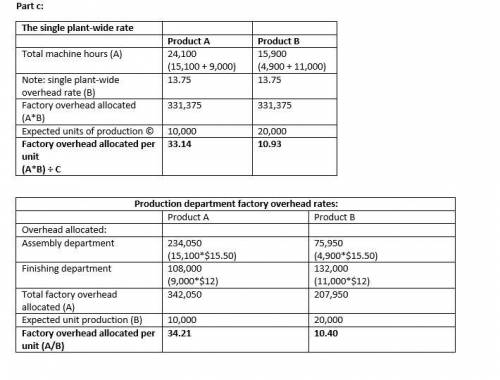

Condoleezza Co. manufactures two products, A and B, in two production departments, Assembly and Finishing. Condoleezza Co. expects to produce 10,000 units of Product A and 20,000 units of Product B in the coming year. Budgeted factory overhead costs for the coming year are: Assembly $310,000 Finishing 240,000 Total $550,000 The machine hours expected to be used in the coming year are as follows: Assembly Department Finishing Department Product A 15,100 9,000 Product B 4,900 11,000 Total 20,000 20,000 Round your answers to two decimal places, if necessary. a. Compute the plantwide factory overhead rate, assuming the single plantwide factory overhead rate method is used. $ per mh b. Compute the production department factory overhead rates, assuming the multiple production department factory overhead rate method is used. Assembly Dept. $ per mh Finishing Dept. $ per mh c. Compute the factory overhead allocated per unit for each product using: The single plantwide rate: Product A $ per unit Product B $ per unit Production department factory overhead rates: Product A $ per unit Product B $ per unit d. Which method is better (single or multiple)

Answers: 2

Another question on Business

Business, 21.06.2019 13:30

The chart shows the pricing history for two items. which person saved the most money by buying a product at the right time? carrie, who waited six months to buy a game system timothy, who bought a game system right away because it was popular eugene, who bought a phone immediately for fear they would sell out marlene, who waited six months to buy a phone

Answers: 3

Business, 21.06.2019 17:30

The digby's workforce complement will grow by 20% (rounded to the nearest person) next year. ignoring downsizing from automating, what would their total recruiting cost be? assume digby spends the same amount extra above the $1,000 recruiting base as they did last year. select: 1 $2,840,000 $3,408,000 $570,000 $475,000

Answers: 1

Business, 22.06.2019 00:00

1tanner invested $135,000 cash along with office equipment valued at $32,400 in the company in exchange for common stock. 2 the company prepaid $7,200 cash for 12 months’ rent for office space. (hint: debit prepaid rent for $7,200.) 3 the company made credit purchases for $16,200 in office equipment and $3,240 in office supplies. payment is due within 10 days. 6 the company completed services for a client and immediately received $2,000 cash. 9 the company completed a $10,800 project for a client, who must pay within 30 days. 13 the company paid $19,440 cash to settle the account payable created on april 3. 19 the company paid $6,000 cash for the premium on a 12-month insurance policy. (hint: debit prepaid insurance for $6,000.) 22 the company received $8,640 cash as partial payment for the work completed on april 9. 25 the company completed work for another client for $2,640 on credit. 28 the company paid $6,200 cash in dividends. 29 the company purchased $1,080 of additional office supplies on credit. 30 the company paid $700 cash for this month’s utility bill. prepare general journal entries to record these transactions. 2. post the journal entries from part 1 to the ledger accounts.

Answers: 2

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

You know the right answer?

Condoleezza Co. manufactures two products, A and B, in two production departments, Assembly and Fini...

Questions

Biology, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

History, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

Chemistry, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

Social Studies, 02.03.2021 21:20

Mathematics, 02.03.2021 21:20

History, 02.03.2021 21:20