Business, 27.03.2020 22:51 lileljusto2829

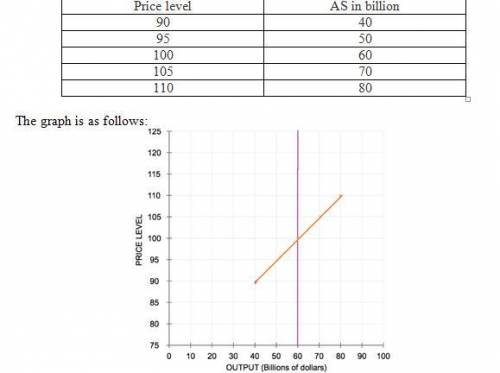

In the short run, the quantity of output that firms supply can deviate from the natural rate of output if the actual price level in the economy deviates from the expected price level. Several theories explain how this might happen. For example, the sticky-price theory asserts that the output prices of some goods and services adjust slowly to changes in the price level. Suppose firms announce the prices for their products in advance, based on an expected price level of 100 for the coming year. Many of the firms sell their goods through catalogs and face high costs of reprinting if they change prices. The actual price level turns out to be 90. Faced with high menu costs, the firms that rely on catalog sales choose not to adjust their prices. Sales from catalogs will (Remain the same/fall/rise), and firms that rely on catalogs will respond by (Increasing/Reducing) the quantity of output they supply. If enough firms face high costs of adjusting prices, the unexpected decrease in the price level causes the quantity of output supplied to (Fall below/Rise above) the natural rate of output in the short run. Suppose the economy's short-run aggregate supply (AS) curve is given by the following equation:Quantity of output supplied = Natural Rate of output + a x (Price level (actual) - Price level (expected))The Greek letter a represents a number that determines how much output responds to unexpected changes in the price level. In this case, assume that a= $2 Billion. That is, when the actual price level exceeds the expected price level by 1, the quantity of output supplied will exceed the natural rate of output by $2 billion. Suppose the natural rate of output is $60 billion of real GDP and that people expect a price level of 100.The short-run quantity of output supplied by firms will rise above the natural rate of output when the actual price level (rises above/falls below) the price level that people expected.

Answers: 3

Another question on Business

Business, 22.06.2019 13:00

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 17:40

Slimwood corporation made sales of $ 725 million during 2018. of this amount, slimwood collected cash for $ 670 million. the company's cost of goods sold was $ 300 million, and all other expenses for the year totaled $ 400 million. also during 2018, slimwood paid $ 420 million for its inventory and $ 285 million for everything else. beginning cash was $ 110 million. carter's top management is interviewing you for a job and they ask two questions: (a) how much was carter's net income for 2018? (b) how much was carter's cash balance at the end of 2016? you will get the job only if you answer both questions correctly.

Answers: 1

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

You know the right answer?

In the short run, the quantity of output that firms supply can deviate from the natural rate of outp...

Questions

Mathematics, 04.10.2021 20:20

Mathematics, 04.10.2021 20:20

Mathematics, 04.10.2021 20:20

SAT, 04.10.2021 20:20

English, 04.10.2021 20:20