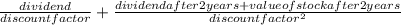

Suppose you are thinking of purchasing the stock of Moore Oil, Inc. You expect it to pay a $2.2 dividend in one year, and you require a return of 10% on investments of this risk. In addition to the dividend in one year, you expect a dividend of $2.40 in two years and a stock price of $14.60 at the end of year 2. Now how much would you be willing to pay?

a. $15

b. $14

c. $10

d. $11

e. $12

f. $13

g. $16

h. $17

i. $18

Answers: 3

Another question on Business

Business, 22.06.2019 03:40

Your parents have accumulated a $170,000 nest egg. they have been planning to use this money to pay college costs to be incurred by you and your sister, courtney. however, courtney has decided to forgo college and start a nail salon. your parents are giving courtney $20,000 to her get started, and they have decided to take year-end vacations costing $8,000 per year for the next four years. use 8 percent as the appropriate interest rate throughout this problem. use appendix a and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. how much money will your parents have at the end of four years to you with graduate school, which you will start then?

Answers: 1

Business, 22.06.2019 14:20

For the year ended december 31, a company has revenues of $323,000 and expenses of $199,000. the company paid $52,400 in dividends during the year. the balance in the retained earnings account before closing is $87,000. which of the following entries would be used to close the dividends account?

Answers: 3

Business, 22.06.2019 17:30

Which curve shows increasing opportunity cost as you give up more of one option? demand curve bow-shaped curve yield curve indifference curve

Answers: 3

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

You know the right answer?

Suppose you are thinking of purchasing the stock of Moore Oil, Inc. You expect it to pay a $2.2 divi...

Questions

Mathematics, 30.08.2019 14:00

Social Studies, 30.08.2019 14:00

Business, 30.08.2019 14:00

Biology, 30.08.2019 14:00

English, 30.08.2019 14:00

Mathematics, 30.08.2019 14:00

Mathematics, 30.08.2019 14:00

English, 30.08.2019 14:00

Mathematics, 30.08.2019 14:00

Mathematics, 30.08.2019 14:00

World Languages, 30.08.2019 14:00