Business, 28.03.2020 01:57 taylorlindsey9329

Consider three bonds with 5.50% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

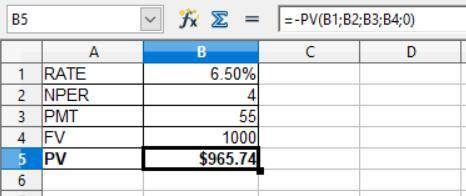

a. What will be the price of the 4-year bond if its yield increases to 6.50%?

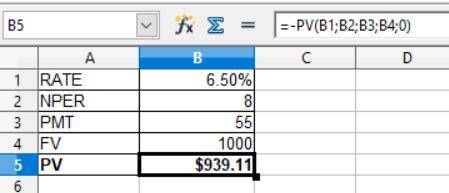

b. What will be the price of the 8-year bond if its yield incrteases to 6.50%?

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill. student a incorrect which is correct answer?

Answers: 2

Business, 22.06.2019 13:00

Explain the relationship between consumers and producers in economic growth and activity

Answers: 1

Business, 22.06.2019 17:30

According to management education expert ashok rao, companies can increase their profitability by through careful inventory management. a. 5% to 10% b. 10% to 25% c. 20% to 50% d. 75%

Answers: 1

Business, 22.06.2019 21:50

Which three of the following expenses can student aid recover? -tuition -television -school supplies -parties and socializing -boarding/housing

Answers: 2

You know the right answer?

Consider three bonds with 5.50% coupon rates, all making annual coupon payments and all selling at f...

Questions

Mathematics, 15.10.2020 02:01

English, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01

English, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01

Business, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01

English, 15.10.2020 02:01

History, 15.10.2020 02:01

History, 15.10.2020 02:01

Business, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01

Biology, 15.10.2020 02:01

Mathematics, 15.10.2020 02:01