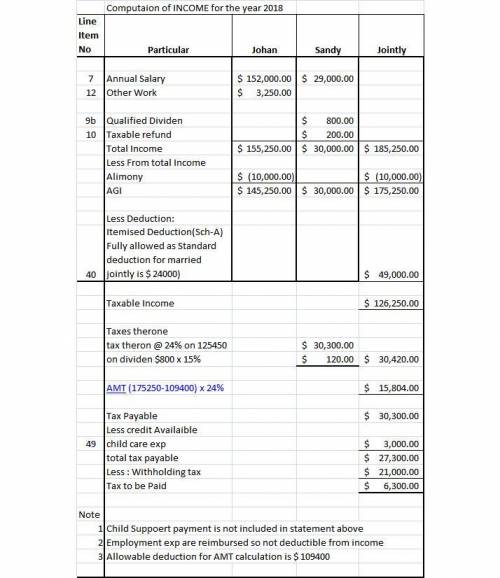

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2018, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part-time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA).

The Fergusons reported making the following payments during the year:

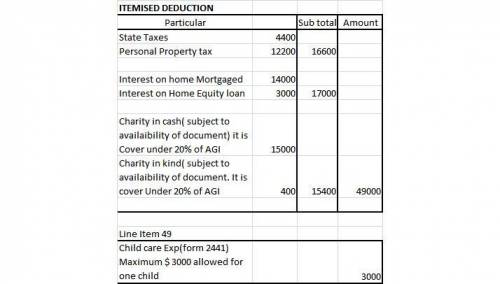

State income taxes of $4,400. Federal tax withholding of $21,000.

Alimony payments to John’s former wife of $10,000 (divorced in 2014).

Child support payments for John’s child with his former wife of $4,100.

$12,200 of real property taxes.

Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer.

$3,600 to Kid Care day care center for Samantha’s care while John and Sandy worked.

$14,000 interest on their home mortgage ($400,000 acquisition debt).

$3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car.

$15,000 cash charitable contributions to qualified charities.

Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000.

What is the Fergusons' 2018 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable?

Answers: 2

Another question on Business

Business, 22.06.2019 06:30

If a team of three workers, each making the u.s. federal minimum wage, produced these 12 rugs, what would the total labor cost be? don't forget that these workers would be working overtime.

Answers: 3

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

Business, 23.06.2019 00:40

Skathy lee berggren, a professor of oral communication at cornell university, indicates “a lot of my students really [only] scratch the surface with the type of research they’re doing.” according to andy guess, at inside higher ed, “just because students walk in the door as ‘digital natives’, doesn’t mean they’re equipped to handle the heavy lifting of digital databases and proprietary search engines that comprise the bulk of modern, online research techniques.” students erroneously think a google search is research. as you read through the reasons that should stimulate your interest in studying research methods or evaluate the nine factors that guarantee good research, what actions do you propose to narrow the gap between students’ research competence and what’s required of a modern college graduate about to become a manage

Answers: 1

Business, 23.06.2019 02:10

Which of the following most accurately describes how the equilibrium price of a good or service can be determined? a. by moving the supply curve right or left until it matches the demand curve. b. by finding where the supply curve and the demand curve intersect. c. by doing market research to determine the maximum price consumers will pay. d. by taking the opposite of the columns in a supply schedule and a demand schedule.

Answers: 2

You know the right answer?

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In...

Questions

History, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50

History, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50

Chemistry, 09.11.2020 21:50

Mathematics, 09.11.2020 21:50