Suppose that a firm’s recent earnings per share and dividend per share are $2.50 and $1.50, respectively. Both are expected to grow at 9 percent. However, the firm’s current P/E ratio of 24 seems high for this growth rate. The P/E ratio is expected to fall to 20 within five years.

Compute the dividends over the next five years.

Compute the value of this stock in five years.

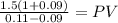

Calculate the present value of these cash flows using an 11 percent discount rate.

Answers: 1

Another question on Business

Business, 23.06.2019 01:30

Jodie lives in a developing nation where the local markets are underdeveloped in terms of domestic exposure. her country wants to boost these domestic industries in the face of heavy competition from foreign players in the market. which trade practice should jodie’s country adopt to shield its domestic industries from foreign players? jodie’s country should adopt to shield its domestic industries from foreign players. typing answer

Answers: 1

Business, 23.06.2019 10:00

Bagwell's net income for the year ended december 31, year 2 was $189,000. information from bagwell's comparative balance sheets is given below. compute the cash received from the sale of its common stock during year 2. at december 31 year 2 year 1 common stock, $5 par value $ 504,000 $ 453,600 paid-in capital in excess of par 952,000 856,600 retained earnings 692,000 585,600

Answers: 3

Business, 23.06.2019 11:20

In a hypothetical economy, a market basket consists of one laptop and two dvd players. in the base year, 2010, the price of a dvd player was $200, and the price of a laptop was $500. in 2015, the price of a dvd player was $380, and the price of a laptop was $750. the cpi for 2010 was

Answers: 3

Business, 23.06.2019 15:00

Aplant manager is considering buying additional stamping machines to accommodate increasing demand. the alternatives are to buy 1 machine, 2 machines, or 3 machines. the profits realized under each alternative are a function of whether their bid for a recent defense contract is accepted or not. the payoff table below illustrates the profits realized (in $000's) based on the different scenarios faced by the manager. alternative bid accepted bid rejected buy 1 machine $10 $5 buy 2 machines $30 $4 buy 3 machines $40 $2 refer to the information above. assume that based on historical bids with the defense contractor, the plant manager believes that there is a 65% chance that the bid will be accepted and a 35% chance that the bid will be rejected. what is the expected value under perfect information (evpi)?

Answers: 1

You know the right answer?

Suppose that a firm’s recent earnings per share and dividend per share are $2.50 and $1.50, respec...

Questions

History, 06.10.2020 16:01

History, 06.10.2020 16:01

Biology, 06.10.2020 16:01

Computers and Technology, 06.10.2020 16:01

Mathematics, 06.10.2020 16:01

Mathematics, 06.10.2020 16:01

Biology, 06.10.2020 16:01

Mathematics, 06.10.2020 16:01

Biology, 06.10.2020 16:01

Mathematics, 06.10.2020 16:01

Computers and Technology, 06.10.2020 16:01

Health, 06.10.2020 16:01