Business, 30.03.2020 20:27 elijahcarson9015

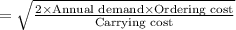

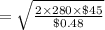

Problem 10A specialty coffeehouse sells Colombian coffee at a fairly steady rate of 280 pounds annually. The beans are purchased from a local supplier for $2.40 per pound. The coffeehouse estimates that it costs $45 in paperwork and labor to place an order for the coffee, and holding costs are based on a 20 percent annual interest rate. a)Determine the optimal order quantity for Colombian coffee. b)What is the time between placement of orders?c)What is the average annual cost of holding and setup due to this item?d)If replenishment lead time is three weeks, determine the reorder level based on the on-hand inventory.

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

In risk management, what does risk control include? a. risk identification b. risk analysis c. risk prioritization d. risk management planning e. risk elimination need this answer now : (

Answers: 3

Business, 22.06.2019 11:30

Which of the following is not an example of one of the four mail advantages of prices on a free market economy

Answers: 1

Business, 22.06.2019 21:20

Rediger inc., a manufacturing corporation, has provided the following data for the month of june. the balance in the work in process inventory account was $28,000 at the beginning of the month and $20,000 at the end of the month. during the month, the corporation incurred direct materials cost of $56,200 and direct labor cost of $29,800. the actual manufacturing overhead cost incurred was $53,600. the manufacturing overhead cost applied to work in process was $52,200. the cost of goods manufactured for june was:

Answers: 2

Business, 23.06.2019 14:30

The manda panda company uses the allowance method to account for bad debts. at the beginning of 2018, the allowance account had a credit balance of $92,400. credit sales for 2018 totaled $3,190,000 and the year-end accounts receivable balance was $507,500. during this year, $88,500 in receivables were determined to be uncollectible. manda panda anticipates that 3% of all credit sales will ultimately become uncollectible. the fiscal year ends on december 31. required: 1. does this situation describe a loss contingency? 2. what is the bad debt expense that manda panda should report in its 2018 income statement? 3. prepare the appropriate journal entry to record the contingency. 4. complete the table below to calculate the net realizable value manda panda should report in its 2018 balance sheet?

Answers: 2

You know the right answer?

Problem 10A specialty coffeehouse sells Colombian coffee at a fairly steady rate of 280 pounds annua...

Questions

Mathematics, 05.01.2020 13:31

History, 05.01.2020 13:31

Mathematics, 05.01.2020 13:31

Geography, 05.01.2020 13:31

Health, 05.01.2020 13:31

Mathematics, 05.01.2020 13:31

English, 05.01.2020 13:31

Physics, 05.01.2020 13:31

Mathematics, 05.01.2020 13:31

History, 05.01.2020 13:31

Mathematics, 05.01.2020 13:31