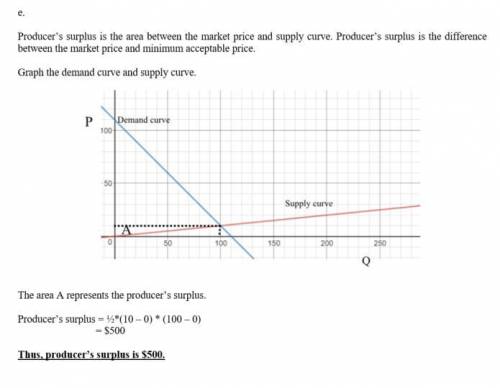

The bolt-making industry currently consists of 20 producers, all of whom operate with the identical short-run total cost curves �(�) = 16 + �), where q is the annual output of a firm. The market demand for bolts is �- = 110 − � (assume that the industry is perfectly competitive). a. What is the firm's short-run supply curve? b. What is the short-run market supply curve? c. Determine the short-run equilibrium price and quantity in this industry. d. What is each firm’s profit? e. What is the aggregate producer surplus?

Answers: 2

Another question on Business

Business, 21.06.2019 16:20

Match each of the terms below with an example that fits the term. a. fungibility the production of gasoline b. inelasticity the switch from coffee to tea c. non-excludability the provision of national defense d. substitution the demand for cigarettes

Answers: 3

Business, 22.06.2019 01:30

Juwana was turned down for a car loan by a local credit union she thought her credit was good what should her first step be

Answers: 1

Business, 22.06.2019 03:30

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 11:40

Vendors provide restaurants with what? o a. cooked items ob. raw materials oc. furniture od. menu recipes

Answers: 1

You know the right answer?

The bolt-making industry currently consists of 20 producers, all of whom operate with the identical...

Questions

Mathematics, 15.12.2020 21:40

Health, 15.12.2020 21:40

Mathematics, 15.12.2020 21:40

History, 15.12.2020 21:40

Computers and Technology, 15.12.2020 21:40

Mathematics, 15.12.2020 21:40

Mathematics, 15.12.2020 21:40

Physics, 15.12.2020 21:40

Mathematics, 15.12.2020 21:40

Mathematics, 15.12.2020 21:40

Physics, 15.12.2020 21:40

Social Studies, 15.12.2020 21:40