Business, 04.04.2020 12:18 dariannalopez5902

Labor costs represent a large percentage of total costs for many firms. According to data from the Bureau of Labor Statistics, U. S. labor costs were up 2.0% in 2015, compared to 2014.

a. When labor costs increase, what happens to average total cost and marginal cost? Consider a case in which labor costs are only variable costs and a case in which they are both variable and fixed costs. An increase in labor productivity means each worker can produce more output. Recent data on productivity show that labor productivity in the U. S. nonfarm business sector grew by 1.7% between 1970 and 1999, by 2.6% between 2000 and 2009, and by 1.1% between 2010 and 2015.

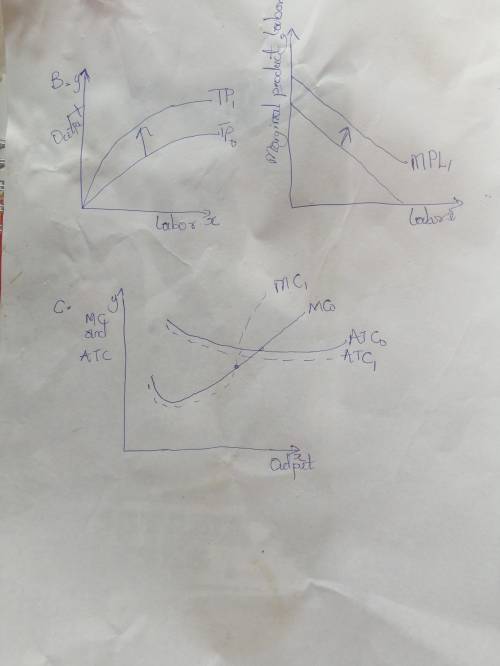

b. When productivity growth is positive, what happens to the total product curve and the marginal product of labor curve? Illustrate your answer with a diagram.

c. When productivity growth is positive, what happens to the marginal cost curve and the average total cost curve? llustrate your answer with a diagram.

d. If labor costs are rising over time on average, why would a company want to adopt equipment and methods that increase labor productivity?

Answers: 1

Another question on Business

Business, 21.06.2019 17:00

The risk-free rate is 7% and the expected rate of return on the market portfolio is 11%. a. calculate the required rate of return on a security with a beta of 1.92. (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. if the security is expected to return 15%, is it overpriced or underpriced?

Answers: 2

Business, 21.06.2019 23:00

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $12,500 are payable at the beginning of each year. each is a finance lease for the lessee. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) situation 1 2 3 4 lease term (years) 3 3 3 3 asset’s useful life (years) 3 4 4 6 lessor’s implicit rate (known by lessee) 14 % 14 % 14 % 14 % residual value: guaranteed by lessee 0 $ 5,000 $ 2,500 0 unguaranteed 0 0 $ 2,500 $ 5,000 purchase option: after (years) none 2 3 3 exercise price n/a $ 7,500 $ 1,500 $ 3,500 reasonably certain? n/a no no yes

Answers: 1

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 02:30

When interest is compounded continuously, the amount of money increases at a rate proportional to the amount s present at time t, that is, ds/dt = rs, where r is the annual rate of interest. (a) find the amount of money accrued at the end of 3 years when $4000 is deposited in a savings account drawing 5 3 4 % annual interest compounded continuously. (round your answer to the nearest cent.) $ (b) in how many years will the initial sum deposited have doubled? (round your answer to the nearest year.) years (c) use a calculator to compare the amount obtained in part (a) with the amount s = 4000 1 + 1 4 (0.0575) 3(4) that is accrued when interest is compounded quarterly. (round your answer to the nearest cent.) s = $

Answers: 1

You know the right answer?

Labor costs represent a large percentage of total costs for many firms. According to data from the B...

Questions

Mathematics, 20.08.2019 17:30

French, 20.08.2019 17:30

Mathematics, 20.08.2019 17:30

History, 20.08.2019 17:30

Mathematics, 20.08.2019 17:30

Social Studies, 20.08.2019 17:30

Biology, 20.08.2019 17:30

English, 20.08.2019 17:30

Chemistry, 20.08.2019 17:30

English, 20.08.2019 17:30