Business, 06.04.2020 19:48 cluchmasters5634

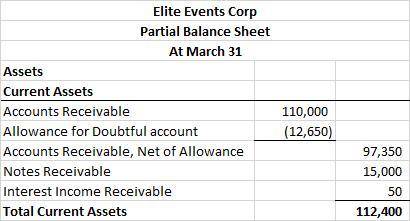

Show how Accounts Receivable, Notes Receivable, and their related accounts would be reported in the current assets section of a classified balance sheet at the end of the quarter on March 31.

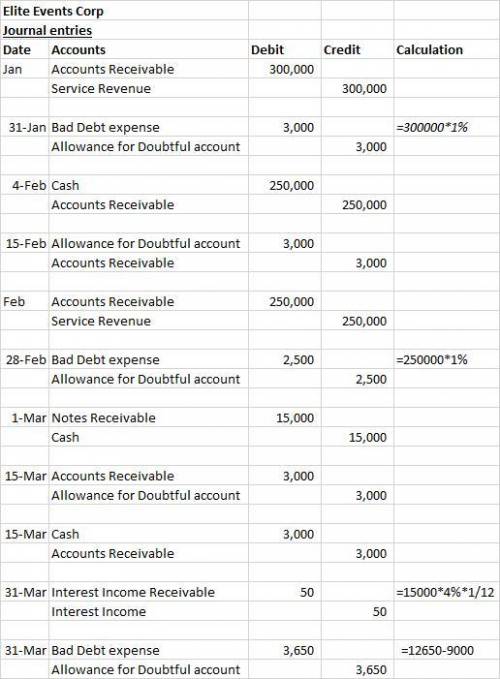

a. During January, the company provided services for $300,000 on credit.

b. On January 31, the company estimated bad debts using 1 percent of credit sales.

c. On February 4, the company collected $250,000 of accounts receivable.

d. On February 15, the company wrote off a $3,000 account receivable.

e. During February, the company provided services for $250,000 on credit.

f. On February 28, the company estimated bad debts using 1 percent of credit sales.

g. On March 1, the company loaned $15,000 to an employee who signed a 4% note, due in 9 months.

h. On March 15, the company collected $3,000 on the account written off one month earlier.

i. On March 31, the company accrued interest earned on the note.

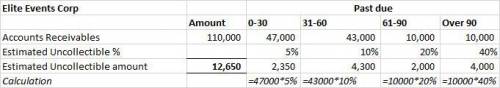

j. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis, which includes the preceding transactions (as well as others not listed). Prior to the adjustment, Allowance for Doubtful Accounts had an unadjusted credit balance of $9,000.

Number of Days Unpaid

Customer Total 0-30 31-60 61-90 Over 90

Aerosmith $ 2,000 1,000 1,000

Biggie Small 2,000 1,000 1,000

Others (not shown to save space)99,000 39,000 42,000 9,000 9,000

ZZ Top 7,000 7,000

Total Accounts Receivable $110,000 $47,000 $43,000 $10,000 $10,000

Estimated uncollectible (%) 5% 10% 20% 40%

Answers: 3

Another question on Business

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 09:20

Which statement best explains the relationship between points a and b? a. consumption reaches its highest point, and then supply begins to fall. b. inflation reaches its highest point, and then the economy begins to expand. c. production reaches its highest point, and then the economy begins to contract. d. unemployment reaches its highest point, and then inflation begins to decrease.

Answers: 2

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

Business, 22.06.2019 15:00

Which of the following characteristics are emphasized in the accounting for state and local government entities? i. revenues should be matched with expenditures to measure success or failure of the government entity. ii. there is an emphasis on expendability of resources to accomplish objectives. a. i only b. ii only c. i and ii d. neither i nor ii

Answers: 2

You know the right answer?

Show how Accounts Receivable, Notes Receivable, and their related accounts would be reported in the...

Questions

Mathematics, 27.02.2020 17:58

Mathematics, 27.02.2020 17:58

Computers and Technology, 27.02.2020 17:58

Mathematics, 27.02.2020 17:58