Business, 07.04.2020 01:19 wfergphilly3159

During 2015, Wright Company sells 470 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for 2015.

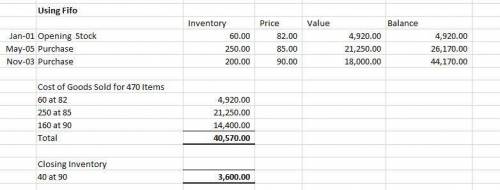

Calculate ending inventory and cost of goods sold for 2015, assuming the company uses FIFO.

Date Transaction Number of Units Unit Cost Total Cost

Jan. 1 Beginning inventory 60 $82 $4,920

May 5 Purchase 250 85 21,250

Nov. 3 Purchase 200 90 18,000

510 $44,170

Calculate ending inventory and cost of goods sold for the year, assuming the company uses specific identification. Actual sales by the company include its entire beginning inventory, 275 units of inventory from the May 5 purchase, and 220 units from the November 3 purchase.

Answers: 3

Another question on Business

Business, 21.06.2019 20:20

Atoy manufacturer makes its own wind-up motors, which are then put into its toys. while the toy manufacturing process is continuous, the motors are intermittent flow. data on the manufacture of the motors appears below.annual demand (d) = 50,000 units daily subassembly production rate = 1,000setup cost (s) = $85 per batch daily subassembly usage rate = 200carrying cost = $.20 per unit per year(a) to minimize cost, how large should each batch of subassemblies be? (b) approximately how many days are required to produce a batch? (c) how long is a complete cycle? (d) what is the average inventory for this problem? (e) what is the total annual inventory cost (holding plus setup) of the optimal behavior in this problem?

Answers: 2

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

You know the right answer?

During 2015, Wright Company sells 470 remote-control airplanes for $110 each. The company has the fo...

Questions

Physics, 08.07.2019 15:40

Biology, 08.07.2019 15:40

Mathematics, 08.07.2019 15:40

Health, 08.07.2019 15:40

History, 08.07.2019 15:40

Mathematics, 08.07.2019 15:40

Mathematics, 08.07.2019 15:40

History, 08.07.2019 15:40

Biology, 08.07.2019 15:40