Business, 07.04.2020 20:28 makaylashrout77

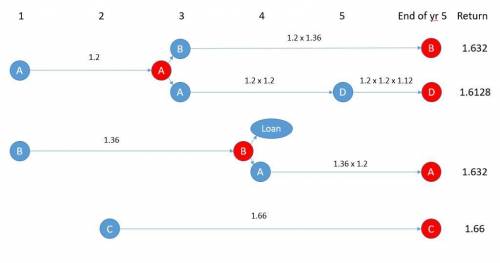

3.12. Retirement Planning Your uncle has $90,000 that he wishes to invest now in order to use the accumulation for purchasing a retirement annuity in five years. After consulting with his financial advisor, he has been offered four types of fixed-income investments, labeled as investments A, B, C, and D. Investments A and B are available at the beginning of each of the next five years (call them years 1-5). Each dollar invested in A at the beginning of a year returns $1.20 (a profit of $0.20) two years later, in time for immediate reinvestment. Each dollar invested in B at the beginning of a year returns $1.36 three years later. Investments C and D will each be available just once in the future. Each dollar invested in C at the beginning of year 2 returns $ 1.66 at the end of year 5. Each dollar invested in D at the beginning of year 5 returns $1.12 at the end of year 5. Your uncle is obligated to make a balloon payment on an existing loan in the amount of $24,000 at the end of year 3. He wants to make that payment out of the investment account. (a) Devise an investment plan for your uncle that maximizes the value of the investment account at the end of five years. How much money will be available for the annuity in five years

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 09:50

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 22.06.2019 12:00

Identify at least 3 body language messages that project a positive attitude

Answers: 2

Business, 23.06.2019 09:30

Craig complained to his friend jess that a class was too hard and he believed that the teacher was not being fair with his grading standards. jess replied, "craig, you really have an attitude problem." what is the relationship between the manner that the term attitude is used in common conversation and the how it is defined in consumer behavior? there is no relationship. common usage is not the same as attitudes as seen by the researchers who study consumer behavior. the term attitude is widely used in popular culture in much the same way it is used in studying consumer behavior. they are different in that popular culture does not recognize that attitudes are temporary. otherwise the usage is the same. they are similar except that popular culture assumes that attitudes are related to beliefs, and research scientists have shown that there is no such relationship.

Answers: 2

You know the right answer?

3.12. Retirement Planning Your uncle has $90,000 that he wishes to invest now in order to use the ac...

Questions

Computers and Technology, 12.12.2019 21:31

Law, 12.12.2019 21:31

Mathematics, 12.12.2019 21:31

Health, 12.12.2019 21:31

History, 12.12.2019 21:31

Mathematics, 12.12.2019 21:31

Computers and Technology, 12.12.2019 21:31