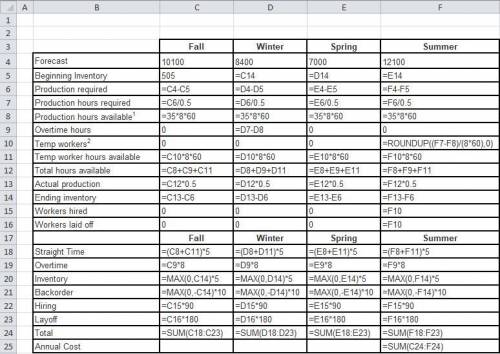

Develop a production plan and calculate the annual cost for a firm whose demand forecast is: fall, 10,100; winter, 8,400; spring, 7,000; summer, 12,100. Inventory at the beginning of fall is 505 units. At the beginning of fall you currently have 35 workers, but you plan to hire temporary workers at the beginning of summer and lay them off at the end of summer. In addition, you have negotiated with the union an option to use the regular workforce on overtime during winter or spring if overtime is necessary to prevent stock-outs at the end of those quarters. Overtime is not available during the fall. Relevant costs are hiring, $90 for each temp; layoff, $180 for each worker laid off; inventory holding, $5 per unit-quarter; backorder, $10 per unit; regular time, $5 per hour; overtime, $8 per hour. Assume that the productivity is 0.5 unit per worker hour, with eight hours per day and 60 days per season. In each quarter, produce to the full output of your regular workforce, even if that results in excess production. In Winter and Spring, use overtime only if needed to meet the production required in that quarter. Do not use overtime to build excess inventory in prior seasons expressly for the purpose of reducing the number of temp workers in Summer.

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

James sebenius, in his harvard business review article: six habits of merely effective negotiators, identifies six mistakes that negotiators make that keep them from solving the right problem. identify which mistake is being described. striving for a “win-win” agreement results in differences being overlooked that may result in joint gains.

Answers: 2

Business, 22.06.2019 14:30

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 19:10

Ancho corp. is an automobile company whose core competency lies in manufacturing petrol- and diesel- based cars. the company realizes that more of its potential customers are switching to electric cars. the r& d department of the company acquires competencies in developing electric cars and launches its first hybrid car, which uses both gas and electricity. in this scenario, ancho is primarilya. leveraging new core competencies to improve current market position. b. redeploying existing core competencies to compete in future markets. c. unlearning existing core competencies to create and compete in markets of the future. d. building new core competencies to protect and extend current market position

Answers: 3

You know the right answer?

Develop a production plan and calculate the annual cost for a firm whose demand forecast is: fall, 1...

Questions

Mathematics, 26.05.2020 05:00

Mathematics, 26.05.2020 05:00

History, 26.05.2020 05:00

History, 26.05.2020 05:00

Biology, 26.05.2020 05:00

History, 26.05.2020 05:00

Mathematics, 26.05.2020 05:00