Business, 07.04.2020 23:08 saucyboyFredo

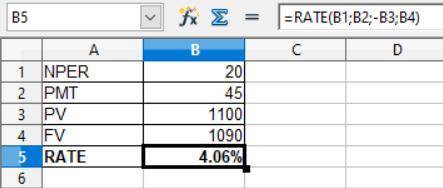

You own a bond with the following features: face value of $1000, coupon rate of 9% (semiannual coupon), and 30 years to maturity. The bond has a current price of $1100. The bond is callable after ten years with the call price of $1090. What is the yield to call if the bond is called at ten years (state as an APR)

Answers: 3

Another question on Business

Business, 21.06.2019 16:30

Which is the correct expansion of the term internet? a. internetwork b. institutional network c. instructional network d. international network

Answers: 2

Business, 22.06.2019 03:10

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

You know the right answer?

You own a bond with the following features: face value of $1000, coupon rate of 9% (semiannual coupo...

Questions

Mathematics, 20.01.2020 19:31

Mathematics, 20.01.2020 19:31