One of the formulas for inventory management says that the average weekly cost of ordering, paying for, and holding merchandise is

A(q) = (km)/q + cm + (hq)/2

Where q is the quantity you order when things run low (shoes, brooms, radios, etc), k is the cost of placing an order (the same, no matter how often you order), c is the cost of one item (a constant), m is the number of items sold each week (a constant), and h is the weekly holding cost per item (a constant that takes into account things such as space, utilities, insurance, and security).

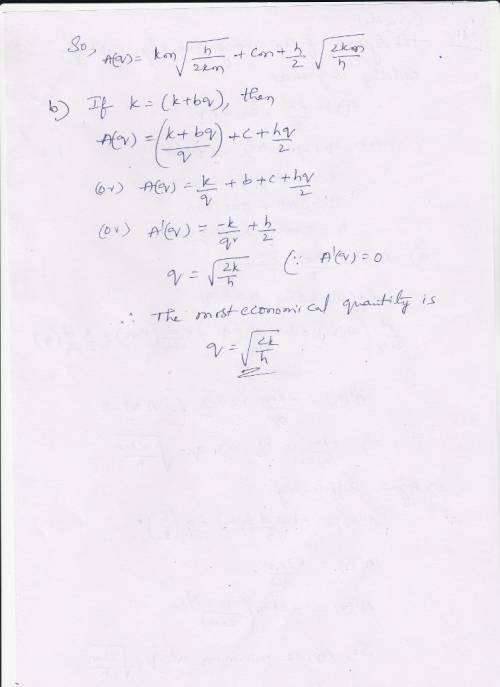

a) Your job, as the inventory manager for your store, is to find the quantity that will minimize A(q). What is it? (The formula you will get for the answer is called the Wilson lot size formula.)

b) Shipping costs sometimes depend on order size. When they do, it is more realistic to replace k by k + bq, the sum of k and a constant multiple of q. What is the most economical quantity to order now?

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 03:10

Complete the sentences. upper a decrease in current income taxes the supply of loanable funds today because it a. decreases; increases disposable income, which decreases saving b. has no effect on; doesn't change expected future disposable income c. decreases; decreases expected future disposable income d. increases; increases disposable income, which encourages greater saving upper a decrease in expected future income a. increases the supply of loanable funds today because households with smaller expected future income will save more today b. has no effect on the supply of loanable funds c. decreases the supply of loanable funds because it decreases wealth d. decreases the supply of loanable funds today because households with smaller expected future income will save less today

Answers: 3

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Business, 22.06.2019 14:50

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

You know the right answer?

One of the formulas for inventory management says that the average weekly cost of ordering, paying f...

Questions

Mathematics, 10.09.2020 01:01

Chemistry, 10.09.2020 01:01

Business, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Engineering, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01

Mathematics, 10.09.2020 02:01