Business, 08.04.2020 22:03 ZaNiyahlove4711

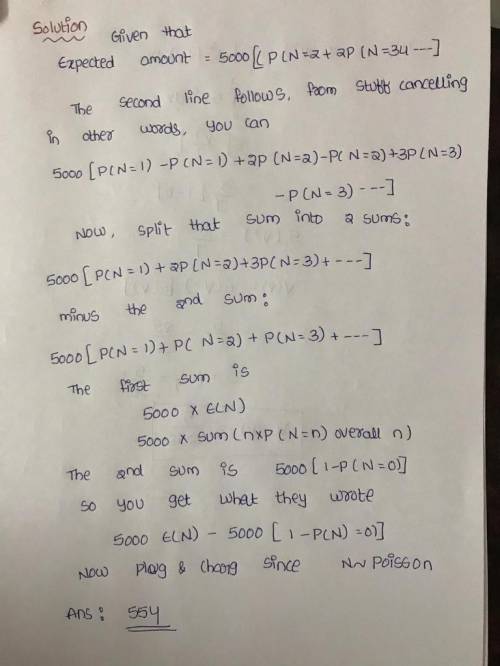

Company XYZ provides a warranty on a product that it produces. Each year, the number of warranty claims follows a Poisson distribution with a mean of c. The probability that no warranty claims are received in any given year is 0.60. Company XYZ purchases an insurance policy that will reduce its overall warranty claim payment costs. The insurance policy will pay nothing for the first warranty claim received and 5000 for each claim there after until the end of the year. Calculate the expected amount of annual insurance policy payments to Company XYZ.

Answers: 3

Another question on Business

Business, 22.06.2019 05:50

Cosmetic profits. sally is the executive vice president of big name cosmetics company. through important and material, nonpublic information, she learns that the company is soon going to purchase a smaller chain of stores. it is expected that stock in big name cosmetics will rise dramatically at that point. sally immediately buys a number of shares of her company's stock. she also tells her friend alice about the expected purchase of stores. alice wanted to purchase stock in the company but lacked the funds with which to do so. although she did not have the funds in bank a, alice decided to draw a check on bank a and deposit the check in bank b and then proceed to write a check on bank b to cover the purchase of the stock. she hoped that she would have sufficient funds to deposit before the check was presented for payment. of which of the following offenses, if any, is alice guilty of by buying stock?

Answers: 2

Business, 22.06.2019 06:00

If you miss two payments on a credit card what is generally the penalty

Answers: 1

Business, 22.06.2019 09:40

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

You know the right answer?

Company XYZ provides a warranty on a product that it produces. Each year, the number of warranty cla...

Questions

Advanced Placement (AP), 08.12.2020 22:30

English, 08.12.2020 22:30

Social Studies, 08.12.2020 22:30

English, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

English, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

Arts, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30

Mathematics, 08.12.2020 22:30