Business, 10.04.2020 05:11 Naysa150724

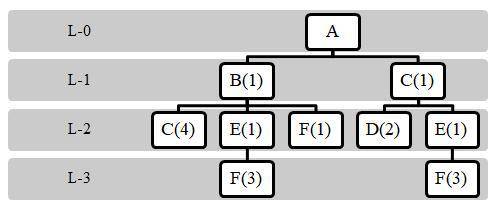

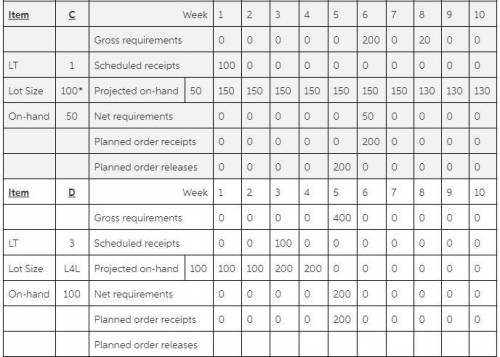

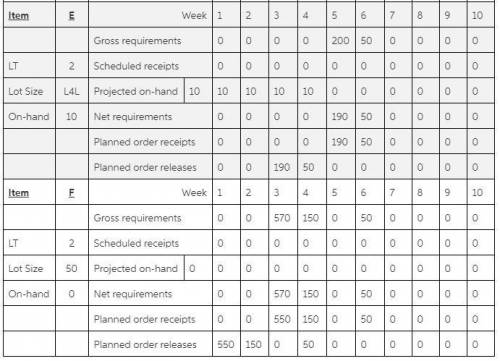

One unit of A is made of one unit of B and one unit of C. B is made of four units of C and one unit each of E and F. C is made of two units of D and one unit of E. E is made of three units of F. Item C has a lead time of one week; Items A, B, E, and F have two-week lead times; and Item D has a lead time of three weeks. Lot-for-lot lot sizing is used for Items A, D, and E; lots of size 50, 100, and 50 are used for Items B, C, and F, respectively. Items A, C, D, and E have on-hand (beginning) inventories of 20, 50, 100, and 10, respectively; all other items have zero beginning inventory. We are scheduled to receive 10 units of A in Week 1, 100 units of C in Week 1, and 100 units of D in Week 3; there are no other scheduled receipts.

Note: To simplify data handling to include the receipt of orders that have actually been placed in previous periods, the following six-level scheme can be used. (A number of different techniques are used in practice, but the important issue is to keep track of what is on hand, what is expected to arrive, what is needed, and what size orders should be placed.)

If 50 units of A are required in Week 10, use the low-level-coded bill of materials (product structure tree) to find the necessary planned order releases for all components.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Employees of dti, inc. worked 1,600 direct labor hours in january and 1,000 direct labor hours in february. dti expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of worker’s compensation insurance cost for the year. the cash payment for this cost will be paid in april. how much insurance premium should be allocated to products made in january and february?

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 14:30

United continental holdings, inc., (ual), operates passenger service throughout the world. the following data (in millions) were adapted from a recent financial statement of united. sales (revenue) $38,901 average property, plant, and equipment 17,219 average intangible assets 8,883 1. compute the asset turnover. round your answer to two decimal places.

Answers: 2

Business, 23.06.2019 02:40

Suppose we are interested in bidding on a piece of land and we know one other bidder is interested. the seller announced that the highest bid in excess of $9,500 will be accepted. assume that the competitor's bid x is a random variable that is uniformly distributed between $9,500 and $15,500. suppose you bid $12,000. what is the probability that your bid will be accepted?

Answers: 2

You know the right answer?

One unit of A is made of one unit of B and one unit of C. B is made of four units of C and one unit...

Questions

Arts, 09.03.2021 19:10

Spanish, 09.03.2021 19:10

Spanish, 09.03.2021 19:10

Arts, 09.03.2021 19:10

Mathematics, 09.03.2021 19:10

Mathematics, 09.03.2021 19:10

English, 09.03.2021 19:10

English, 09.03.2021 19:10

Mathematics, 09.03.2021 19:10

Mathematics, 09.03.2021 19:10