Business, 11.04.2020 00:00 laylay4527

Dougan Company purchased equipment on January 1, 2014 for $90,000. It is estimated that the equipment will have a $5,000 salvage value at the end of its 5-year useful life. It is also estimated that the equipment will produce 100,000 units over its 5-year life.

Answer the following independent questions.

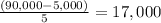

Compute the amount of depreciation expense for the year ended December 31, 2014, using the straight-line method of depreciation.

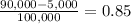

Compute the amount of depreciation expense for the year if 16,000 units of product are produced in 2014 and 24,000 units are produced in 2015 assuming the company uses the units-of-activity depreciation method.

If the company uses the double-declining-balance method of depreciation, what is the depreciation expense for the first three years (2014 – 2016)?

Frank White the new controller of Youngman Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2015. His findings are as follows.

All assets are depreciated by the straight-line method. Youngman Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Frank’s proposed changes.

Compute the revised annual depreciation on each asset for the year of 2015.

Type of Asset Date Acquired Original Cost Accumulated Depreciation (01/01/15) Proposed Useful Life (Yrs) Proposed Salvage Value

Building 1/1/2009 1,600,000 228,000 50 52,000

Warehouse 1/1/2010 207,000 40,000 20 5,000

Answers: 1

Another question on Business

Business, 21.06.2019 16:10

Which one of the following is most apt to align management's priorities with shareholders' interests? compensating managers with shares of stock that must be held for a minimum of three years holding corporate and shareholder meetings at high-end resort-type locations preferred by managers increasing the number of paid holidays that long-term employees are entitled to receive allowing employees to retire early with full retirement benefits paying a special management bonus on every fifth year of employment

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

Business, 22.06.2019 15:10

You want to have $80,000 in your savings account 11 years from now, and you’re prepared to make equal annual deposits into the account at the end of each year. if the account pays 6.30 percent interest, what amount must you deposit each year? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answers: 1

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

You know the right answer?

Dougan Company purchased equipment on January 1, 2014 for $90,000. It is estimated that the equipmen...

Questions

History, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

History, 22.06.2019 20:00

Physics, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

Mathematics, 22.06.2019 20:00

per unit

per unit