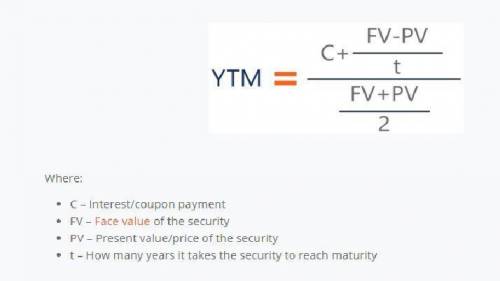

The Petit Chef Co. has 7 percent coupon bonds on the market with 9 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the bonds currently sell for $1,038.50, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

Which of the following is an example of the use of fiscal policy by the u.s. government? a. congress makes it illegal for the police union to go on strike. b. the federal reserve bank lowers the interest rate on loans to corporations. c. the department of transportation increases spending on highway repairs. d. the supreme court rules that unions have the right to collective bargaining. 2b2t

Answers: 1

Business, 22.06.2019 14:30

crow design, inc. is a web site design and consulting firm. the firm uses a job order costing system in which each client is a different job. crow design assigns direct labor, licensing costs, and travel costs directly to each job. it allocates indirect costs to jobs based on a predetermined overhead allocation rate, computed as a percentage of direct labor costs. direct labor hours (professional) 6,250 hours direct labor costs ($1,800,000 support staff salaries ,000 computer ,000 office ,000 office ,000 in november 2012, crow design served several clients. records for two clients appear here: delicious treats mesilla chocolates direct labor 700 hours 100 hours software licensing $ 4,000 $400 travel costs 8,000 1. compute crow design’s direct labor rate and its predetermined indirect cost allocation rate for 2012. 2. compute the total cost of each job. 3. if simone wants to earn profits equal to 50% of service revenue, how much (what fee) should she charge each of these two clients? 4. why does crow design assign costs to jobs?

Answers: 2

Business, 22.06.2019 16:00

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Business, 22.06.2019 17:30

Palmer frosted flakes company offers its customers a pottery cereal bowl if they send in 3 boxtops from palmer frosted flakes boxes and $1. the company estimates that 60% of the boxtops will be redeemed. in 2012, the company sold 675,000 boxes of frosted flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. if the bowls cost palmer company $3 each, how much liability for outstanding premiums should be recorded at the end of 2012?

Answers: 2

You know the right answer?

The Petit Chef Co. has 7 percent coupon bonds on the market with 9 years left to maturity. The bonds...

Questions

World Languages, 12.12.2020 16:30

Computers and Technology, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Biology, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30

Mathematics, 12.12.2020 16:30