Business, 14.04.2020 22:40 alisaharnauth

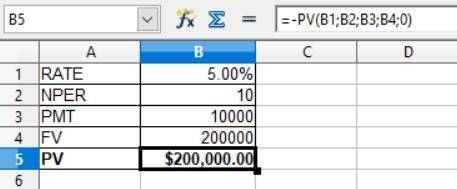

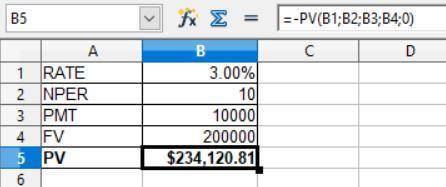

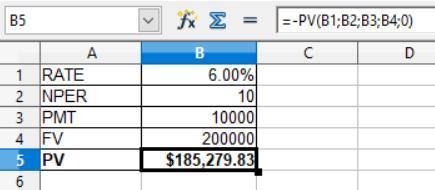

Matt Enterprises issued $200,000 of ten percent, five-year bonds with interest payable semiannually. Determine the issue price if the bonds are priced to yield (a) ten percent, (b) six percent, and (c) 12 percent.

Answers: 3

Another question on Business

Business, 22.06.2019 10:40

At cooly cola, we are testing the appeal of our new diet one cola. in a taste test of 250 randomly chosen cola drinkers, 200 consumers preferred diet one cola to the leading brand. assuming that the sample were large enough, the large-sample 95% confidence interval for the population proportion of cola drinkers that prefer diet one cola would be:

Answers: 1

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

Business, 23.06.2019 00:20

Barney corporation recognized a $100 million preferred stock balance on 12/31/2019. on january 1, 2020, barney issued $10 million in preferred dividends. on the same date, barney raised an additional $20 million via a new issuance of preferred stock. on december 31, 2020, the market value of the original amount of preferred shares rose $5 million. under us gaap, the 12/31/2020 year ending preferred stock balance is:

Answers: 3

Business, 23.06.2019 08:00

If consumers start to believe they need a product, what is likely to happen? a. the demand becomes less elastic. b. the demand becomes more elastic. c. the supply decreases. d. the price decreases.

Answers: 1

You know the right answer?

Matt Enterprises issued $200,000 of ten percent, five-year bonds with interest payable semiannually....

Questions

History, 18.02.2022 06:00

Geography, 18.02.2022 06:00

Mathematics, 18.02.2022 06:00

Mathematics, 18.02.2022 06:10

History, 18.02.2022 06:10

Mathematics, 18.02.2022 06:10

History, 18.02.2022 06:10

Law, 18.02.2022 06:10

History, 18.02.2022 06:10