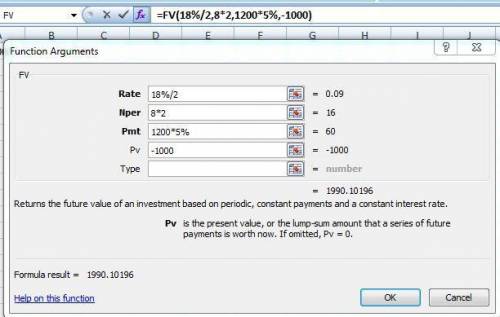

You bought a bond 8 years ago for $1,000. It has a $1,200 face value and a nominal annual bond rate of 10%, paid semiannually (so it pays 5% of the face value every 6 months). You'd like to sell it now and get a nominal annual yield of 18%. How much should you sell the bond for?

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 11:30

Amano s preguntes cationing to come fonds and consumer good 8. why did the u.s. government use rationing for some foods and consumer goods during world war ii?

Answers: 1

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

Business, 22.06.2019 22:10

What is private equity investing? who participates in it and why? how is palamon positioned in the industry? how does private equity investing compare with public market investing? what are the similarities and differences between the two? why is palamon interested in teamsystem? does it fit with palamon’s investment strategy? how much is 51% of teamsystem’s common equity worth? use both a discounted cash flow and a multiple-based valuation to justify your recommendation. what complexities do cross-border deals introduce? what are the specific risks of this deal? what should louis elson recommend to his partners? is it a go or not? if it is a go, what nonprice terms are important? if it’s not a go, what counterproposal would you make?

Answers: 1

You know the right answer?

You bought a bond 8 years ago for $1,000. It has a $1,200 face value and a nominal annual bond rate...

Questions

Mathematics, 04.09.2020 01:01

Physics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

History, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Mathematics, 04.09.2020 01:01

Biology, 04.09.2020 01:01

Health, 04.09.2020 01:01