Business, 15.04.2020 00:26 katherine78

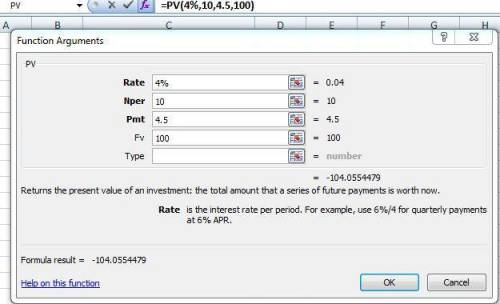

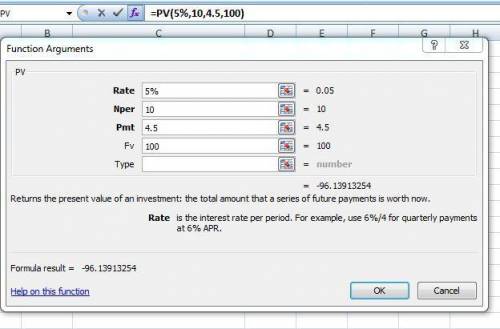

An AA-rated corporate bond has a yield to maturity of 10%. A U. S. Treasury security has a yield to maturity of 8%. These yields are quoted as APRs with semi-annual compounding. Both bonds pay semi-annual coupons at an annual rate of 9% (i. e., coupon rate) and have five years to maturity. The face value of both bonds is $100. a) What is the price of the Treasury bond? b) What is the price of the AA-rated corporate bond? c) What is the credit spread on the AA-bonds?

Answers: 2

Another question on Business

Business, 22.06.2019 05:00

Which of the following are considered needs? check all that apply

Answers: 1

Business, 22.06.2019 12:30

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

You know the right answer?

An AA-rated corporate bond has a yield to maturity of 10%. A U. S. Treasury security has a yield to...

Questions

Physics, 26.08.2020 06:01

Spanish, 26.08.2020 06:01

Social Studies, 26.08.2020 06:01

History, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

English, 26.08.2020 06:01

Chemistry, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01

Biology, 26.08.2020 06:01

Social Studies, 26.08.2020 06:01

Mathematics, 26.08.2020 06:01