Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows:

Stock Expected Return Standard Deviation

A 14% 5%

B 15% 13%

Correlation = –1

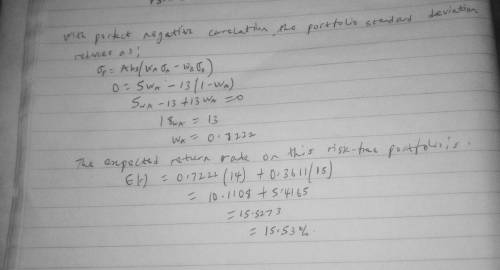

(a) Suppose that it is possible to borrow at the risk-free rate, rf. What must be the value of the risk-free rate? (Hint: Think about constructing a risk-free portfolio from stocks A and B.)

Answers: 3

Another question on Business

Business, 21.06.2019 16:30

Which of the following is the least effective way to reach a potential sales prospect? referral cold call direct mail personal visit

Answers: 3

Business, 21.06.2019 18:00

Emily bought 200 shares of abc co. stock for $29.00 per share on 60% margin. assume she holds the stock for one year and that her interest costs will be $80 over the holding period. ignoring commissions, what is her percentage return (loss) on invested capital if the stock price went down 10%?

Answers: 2

Business, 21.06.2019 18:30

Why should organizations be allowed to promote offensive, violent, sexual, or unhealthy products that can be legally sold and purchased?

Answers: 3

Business, 22.06.2019 10:20

The following information is for alex corp: product x: revenue $12.00 variable cost $4.50 product y: revenue $44.50 variable cost $9.50 total fixed costs $75,000 what is the breakeven point assuming the sales mix consists of two units of product x and one unit of product y?

Answers: 3

You know the right answer?

Suppose that there are many stocks in the security market and that the characteristics of stocks A a...

Questions

History, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30

History, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30

Mathematics, 22.02.2021 21:30