Business, 15.04.2020 03:12 jambunny26

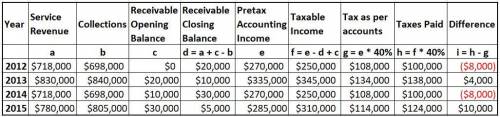

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement, up to six months after services commence. Alsup recognizes service revenue for financial reporting purposes when the services are performed. For tax purposes, revenue is reported when fees are collected. Service revenue, collections, and pretax accounting income for 2012-2015 are as follows:

Service Revenue Collections Pretax Accounting Income2012 $718,000 $698,000 $270,0002013 830,000 840,000 335,0002014 795,000 775,000 305,0002015 780,000 805,000 285,000

There are no differences between accounting income and taxable income other than the temporary difference described above. The enacted tax rate for each year is 40%.(Hint: You may find it helpful to prepare a schedule that shows the balances in service revenue receivable at December 31, 2012-2015.)Required:1. Prepare the appropriate journal entry to record Alsup's 2013 income taxes.2. Prepare the appropriate journal entry to record Alsup's 2014 income taxes.3. Prepare the appropriate journal entry to record Alsup's 2015 income taxes.

Answers: 1

Another question on Business

Business, 22.06.2019 02:00

Answer the following questions using the information below: southwestern college is planning to hold a fund raising banquet at one of the local country clubs. it has two options for the banquet: option one: crestview country club a. fixed rental cost of $1,000 b. $12 per person for food option two: tallgrass country club a. fixed rental cost of $3,000 b. $8.00 per person for food southwestern college has budgeted $1,800 for administrative and marketing expenses. it plans to hire a band which will cost another $800. tickets are expected to be $30 per person. local business supporters will donate any other items required for the event. which option has the lowest breakeven point?

Answers: 1

Business, 22.06.2019 03:40

Your parents have accumulated a $170,000 nest egg. they have been planning to use this money to pay college costs to be incurred by you and your sister, courtney. however, courtney has decided to forgo college and start a nail salon. your parents are giving courtney $20,000 to her get started, and they have decided to take year-end vacations costing $8,000 per year for the next four years. use 8 percent as the appropriate interest rate throughout this problem. use appendix a and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods. a. how much money will your parents have at the end of four years to you with graduate school, which you will start then?

Answers: 1

Business, 22.06.2019 09:40

As related to a company completing the purchase to pay process, is there an accounting journal entry "behind the scenes" when xyz company pays for the goods within 10 days of the invoice (gross method is used for discounts and terms are 2/10 net 30) that updates the general ledger?

Answers: 3

You know the right answer?

Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the...

Questions

Mathematics, 08.03.2021 19:50

History, 08.03.2021 19:50

Mathematics, 08.03.2021 19:50

Mathematics, 08.03.2021 20:00

Mathematics, 08.03.2021 20:00

Mathematics, 08.03.2021 20:00

Arts, 08.03.2021 20:00

Social Studies, 08.03.2021 20:00