Business, 15.04.2020 03:46 wbrandi118

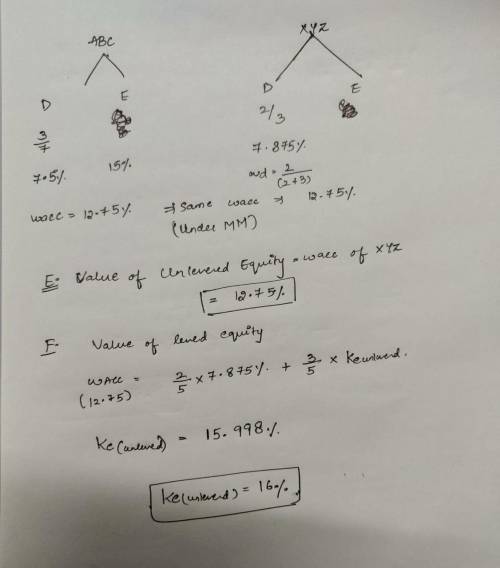

1. ABC and XYZ are two industry competitors, operating under MM perfect capital markets environment. ABC’s market-value-based Debt/Equity ratio is 3/7. Its market-value-based cost of debt, rD, is 7.5% and cost of equity, rE, is 15%. XYZ’s Debt/Equity ratio is 2/3. XYZ’s cost of debt, rD, is 7.875% A. What is the required rate of return on ABC’s assets, rA? B. What is ABC’s weighted average cost of capital (WACC)? Explain. C. What is the required rate of return on XYZ’s assets, rA? Explain. D. What is XYZ’s weighted average cost of capital (WACC)? Explain. E. What is the required rate of return on XYZ’s unlevered equity? Explain. F. What is the required rate of return on XYZ’s levered equity, rE?

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

Adrawback of short-term contracting as an alternative to making a component in-house is thata. it is the most-integrated alternative to performing an activity so the principal company has no control over the agent. b. the supplying firm has no incentive to make any transaction-specific investments to increase performance or quality. c. it fails to allow a long planning period that individual market transactions provide. d. the buying firm cannot demand lower prices due to the lack of a competitive bidding process.

Answers: 2

Business, 22.06.2019 19:10

Do it! review 16-3 the assembly department for right pens has the following production data for the current month. beginning work in process units transferred out ending work in process 0 22,500 16,000 materials are entered at the beginning of the process. the ending work in process units are 70% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs. materials conversion costs the equivalent units of production

Answers: 2

Business, 22.06.2019 19:40

Anita has been named ceo of a popular sports apparel company. as ceo, she is tasked with setting the firm's corporate strategy. which of the following decisions is anita most likely to makea) whether to pursue a differentiation or cost leadership strategy b) which customer segments to target c) how to achieve the highest levels of customer satisfaction d) what range of products the firm should offer

Answers: 2

Business, 23.06.2019 04:40

2. a computer equipment was acquired at the beginning of the year at a cost of $56,000 with an estimated residual value of $5,000, and an estimated useful life of five years. determine the second year’s depreciation expense using the straight-line method.

Answers: 3

You know the right answer?

1. ABC and XYZ are two industry competitors, operating under MM perfect capital markets environment....

Questions

English, 20.10.2021 19:10

History, 20.10.2021 19:10

Mathematics, 20.10.2021 19:10

Chemistry, 20.10.2021 19:10

Mathematics, 20.10.2021 19:10

SAT, 20.10.2021 19:10

Mathematics, 20.10.2021 19:10

Mathematics, 20.10.2021 19:10

Spanish, 20.10.2021 19:10

English, 20.10.2021 19:10