Business, 15.04.2020 15:32 Madalyngarcia20

1.Lionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $24,000 from County Bank and paid interest of $1,440. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for higher education expenses and interest on higher education loans under the following circumstances:

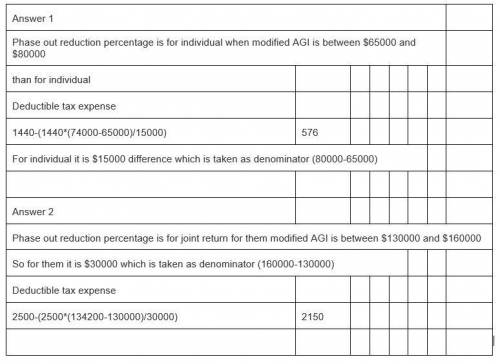

Lionel's AGI before deducting interest on higher education loans is $74,000.

(1) Modified AGI $ 74,000

(2) Amount of interest paid up to $2,500 1,440 Lesser of amount paid or $2,500

(3) Phase-out (reduction) percentage 60 % [(1) − 65,000]/15,000,limited to 100 percent

(4) Phase-out amount (reduction in maximum) 864 (2) × (3)

Deductible interest expense $ 576 (2) − (4)

2.This year Jack intends to file a married-joint return with two dependents. Jack received $162,500 of salary and paid $5,000 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid qualified moving expenses of $4,300 and $24,000 of alimony.

What is Jack's adjusted gross income? Assume that Jack will opt to treat tax items in a manner to minimize his AGI.

AGI is $132,050. Jack's modified AGI calculated without adjustment for educational interest expense is 134,200. He is allowed to deduct part of his student loan interest because his modified AGI is not above $160,000. Jack's maximum deduction before the phase-out is $2,500 (the amount of interest paid up to $2,500). The maximum deduction of $2,500 is phased-out ratably over a $30,000 range beginning with modified AGI over $130,000. Consequently, Jack’s education interest expense deduction is $2,150 = ($2,500 − $2,500 × [($134,200 − 130,000)/30,000]). Jack’s AGI is computed as follows;

Salary and gross income $ 162,500

Less: Alimony – 24,000

Moving expense deduction – 4,300

Modified AGI $ 134,200

Student loan interest deduction – 2,150

AGI $ 132,050

my question:

On Question 1 : [(1) − 65,000]/15,000,limited to 100 percent

On Question 2: ($2,500 − $2,500 × [($134,200 − 130,000)/30,000])

Why 15,000 on question 1 , compared to 30,000 on question 2?

Answers: 3

Another question on Business

Business, 21.06.2019 22:20

Why should you not sign the tenant landlord agreement quickly and immediately

Answers: 1

Business, 22.06.2019 18:10

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

Business, 22.06.2019 19:10

Greenway industries is a major multinational conglomerate. its business units compete in a range of industries, including home appliances, pharmaceuticals, commercial real estate, and plastics manufacturing. although its largest business unit, which produces kitchen appliances, is among the most profitable in the industry, it generates only 35 percent of the company's revenues. which of the following is most likely true of greenway's stock price? a. it is valued at less than the sum of its individual business units. b. it is valued at greater than the sum of individual business units. c. it is valued at the exact sum of individual business units. d. it is consistently lower than the industry average.it is valued at greater than the sum of individual business units.

Answers: 1

Business, 22.06.2019 23:00

How an absolute advantage might affect a country's imports and exports?

Answers: 2

You know the right answer?

1.Lionel is an unmarried law student at State University Law School, a qualified educational institu...

Questions

English, 26.10.2019 02:43

History, 26.10.2019 02:43

History, 26.10.2019 02:43

Health, 26.10.2019 02:43

Mathematics, 26.10.2019 02:43

Mathematics, 26.10.2019 02:43

Social Studies, 26.10.2019 02:43

Mathematics, 26.10.2019 02:43

History, 26.10.2019 02:43

Social Studies, 26.10.2019 02:43

History, 26.10.2019 02:43