Business, 15.04.2020 23:36 mateotrevino1

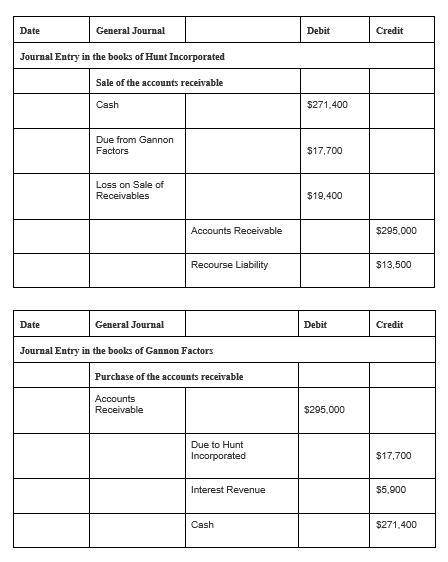

Marigold Incorporated sold $295,000 of accounts receivable to Gannon Factors Inc. on a with recourse basis. Gannon assesses a 2% finance charge of the amount of accounts receivable and retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entries for Marigold Incorporated and Gannon Factors to record the sale of the accounts receivable to Gannon assuming that the recourse liability has a fair value of $13,500

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Afirm that makes electronic circuits has been ordering a certain raw material 250 ounces at a time. the firm estimates that carrying cost is i = 30% per year, and that ordering cost is about $20 per order. the current price of the ingredient is $200 per ounce. the assumptions of the basic eoq model are thought to apply. for what value of annual demand is their action optimal?

Answers: 3

Business, 21.06.2019 23:00

Ajustification for job training programs is that they improve worker productivity. suppose that you are asked to evaluate whether more job training makes workers more productive. however, rather than having data on individual workers, you have access to data on manufacturing firms in ohio. in particu- lar, for each firm, you have information on hours of job training per worker (training) and number of nondefective items produced per worker hour (output). (i) carefully state the ceteris paribus thought experiment underlying this policy question. (ii) does it seem likely that a firm’s decision to train its workers will be independent of worker characteristics? what are some of those measurable and unmeasurable worker characteristics? (iii) name a factor other than worker characteristics that can affect worker productivity. (iv) if you find a positive correlation between output and training, would you have convincingly established that job training makes workers more productive? explain.

Answers: 2

Business, 22.06.2019 01:40

Costs of production that do not change when output changes.question 17 options: total revenuefixed incometotal costfixed cost

Answers: 1

Business, 22.06.2019 16:20

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

Marigold Incorporated sold $295,000 of accounts receivable to Gannon Factors Inc. on a with recourse...

Questions

Mathematics, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30

History, 12.12.2021 05:30

History, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30

Geography, 12.12.2021 05:30

History, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30

Geography, 12.12.2021 05:30

Mathematics, 12.12.2021 05:30