Business, 15.04.2020 23:52 josueur9656

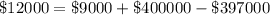

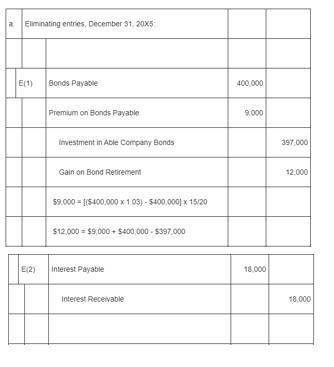

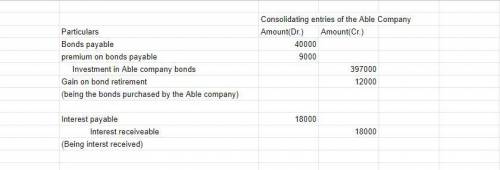

Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Able’s bonds from the original purchaser on December 31, 20X5, for $397,000. Prime owns 60 percent of Able’s voting common stock. a. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20X5What is the bond premium?b. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20X6.What is interest income?What is Interest Expense, Investment in Able. NCIof NA of Able

Answers: 1

Another question on Business

Business, 22.06.2019 00:00

If his parents cannot alex with college, and two of his scholarships will be awarded to other students if he does not accept them immediately, which is the best option for him?

Answers: 1

Business, 22.06.2019 11:30

Chuck, a single taxpayer, earns $80,750 in taxable income and $30,750 in interest from an investment in city of heflin bonds. (use the u.s. tax rate schedule.) (do not round intermediate calculations. round your answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 19:50

Aproduction line has three machines a, b, and c, with reliabilities of .96, .86, and .85, respectively. the machines are arranged so that if one breaks down, the others must shut down. engineers are weighing two alternative designs for increasing the line’s reliability. plan 1 involves adding an identical backup line, and plan 2 involves providing a backup for each machine. in either case, three machines (a, b, and c) would be used with reliabilities equal to the original three. a. compute overall system reliability under plan 1. (round your intermediate calculations and final answer to 4 decimal places.) reliability b. compute overall system reliability under plan 2. (round your intermediate calculations and final answer to 4 decimal places.) reliability c. which plan will provide the higher reliability? plan2plan1

Answers: 3

You know the right answer?

Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds...

Questions

Law, 29.10.2020 22:00

Mathematics, 29.10.2020 22:00

Mathematics, 29.10.2020 22:00

Mathematics, 29.10.2020 22:00

Business, 29.10.2020 22:00

Geography, 29.10.2020 22:00

Mathematics, 29.10.2020 22:00

Computers and Technology, 29.10.2020 22:00

Business, 29.10.2020 22:00

Computers and Technology, 29.10.2020 22:00

Chemistry, 29.10.2020 22:00

Computers and Technology, 29.10.2020 22:00

![=\$9000=[(400000\times1.03)-\$400000]\times\frac{15}{20}](/tpl/images/0603/6632/fd5df.png)