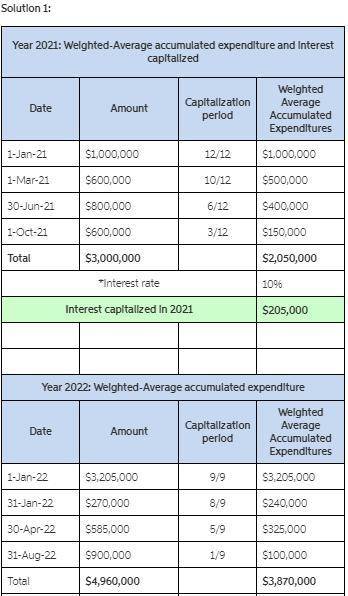

On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows:

January 1, 2021

$

1,000,000

March 1, 2021

600,000

June 30, 2021

800,000

October 1, 2021

600,000

January 31, 2022

270,000

April 30, 2022

585,000

August 31, 2022

900,000

On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2021 and 2022. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The company’s fiscal year-end is December 31.

Required:

Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the specific interest method.

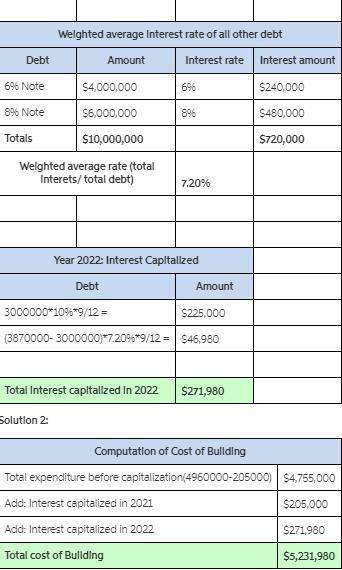

What is the total cost of the building?

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

1) u.s. real gdp is substantially higher today than it was 60 years ago. what does this tell us, and what does it not tell us, about the well-being of u.s. residents? what are the limitations of the gdp as a measure of economic well-being? given the limitations, why is gdp usually regarded as the best single measure of a society’s economic well-being? 2) what is an intermediate good? how does an intermediate good differ from a final good? explain why it is the case that the value of intermediate goods produced and sold during the year is not included directly as part of gdp, but the value of intermediate goods produced and not sold is included directly as part of gdp.

Answers: 2

Business, 23.06.2019 15:20

when taxes are levied on transactions, irrespective of the party they are levied on, a. the government can absorb some of the surplus, but also creates a social loss since some of the wealth creating transactions are discouraged b. the government can absorb all the producer surplus from the transactions as revenue c. the government can absorb all of the surplus (producer and consumer) d. the government can absorb all the consumer surplus from the transactions as revenue

Answers: 2

Business, 23.06.2019 19:50

Describe a situation when you used a text reference successfully to preview, prepare for, review or locate information you were learning.

Answers: 2

Business, 23.06.2019 20:00

What effects does this journal entry have on the accounts? decrease cash and increase land decrease cash and decrease land increase cash and increase land increase cash and decrease land?

Answers: 1

You know the right answer?

On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as i...

Questions

Mathematics, 23.06.2019 07:20

Mathematics, 23.06.2019 07:20

Mathematics, 23.06.2019 07:20

Mathematics, 23.06.2019 07:30

Chemistry, 23.06.2019 07:30

English, 23.06.2019 07:30

Mathematics, 23.06.2019 07:30

Geography, 23.06.2019 07:30

Physics, 23.06.2019 07:30