Business, 16.04.2020 00:44 cynthiagutierrez65

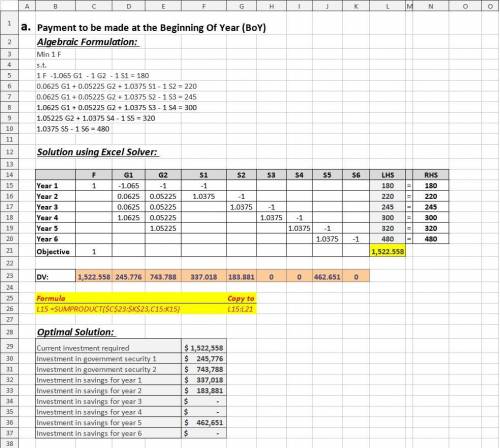

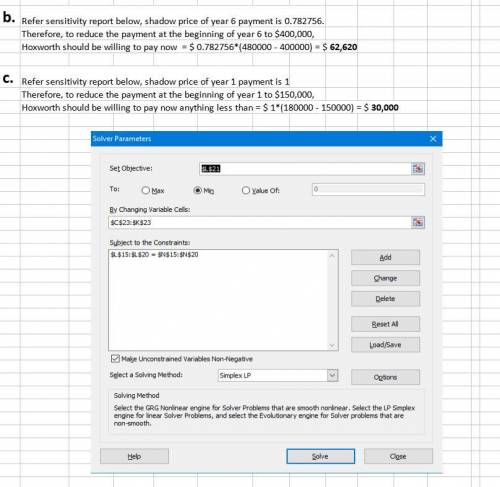

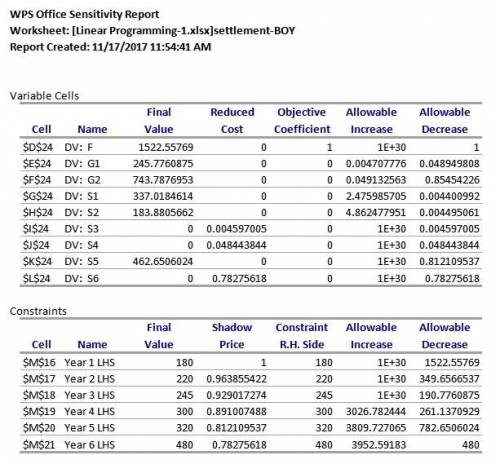

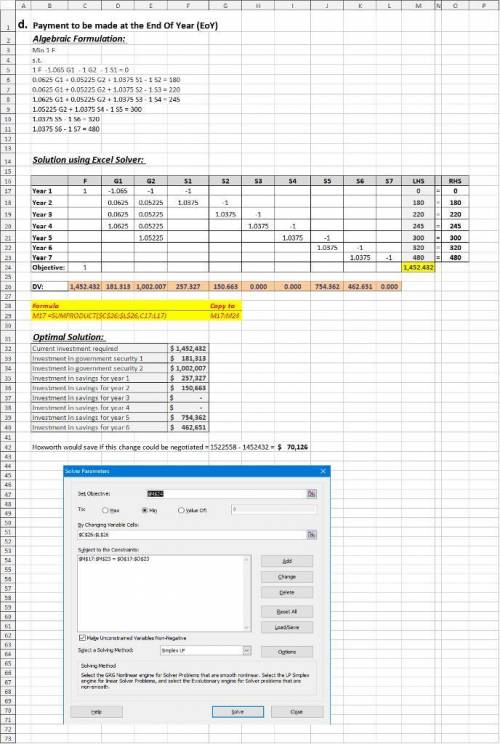

As part of the settlement for a class action lawsuit, Hoxworth Corporation must provide sufficient cash to make the following annual payments (in thousands of dollars): Year 1 2 3 4 5 6 Payment 180 220 245 300 320 480 The annual payments must be made at the beginning of each year. The judge will approve an amount that, along with earnings on its investment, will cover the annual payments. Investment of the funds will be limited to savings (at 3.75% annually) and government securities, at prices and rates currently quoted in The Wall Street Journal. Hoxworth wants to develop a plan for making the annual payments by investing in the following securities (par value = $1000). Funds not invested in these securities will be placed in savings. Security Current Price Rate (%) Years to Maturity 1 $1065 6.25 3 2 $1000 5.225 4 Assume that interest is paid annually. The plan will be submitted to the judge and, if approved, Hoxworth will be required to pay a trustee the amount that will be required to fund the plan. Use linear programming to find the minimum cash settlement necessary to fund the annual payments. Let F = total funds required to meet the six years of payments G1 = units of government security 1 G2 = units of government security 2 Si = investment in savings at the beginning of year i Note: All decision variables are expressed in thousands of dollars. If required, round your answers to four decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300)Min 1 Fs. t.1 F + -1.065 G1 + -1 G2 + - S1 = 180.0625 G1 + .05225 G2 + 1.0375 S1 + - S2 = 220.0675 G1 + .05225 G2 + 1.0375 S2 + - S3 = 2451.0675 G1 + .05525 G2 + 1.0375 S3 + - S4 = 3001.05525 G2 + 1.0375 S4 + - S5 = 3201.0375 S5 + 0 S6 = 480A. Round your answer to the nearest dollar. Current investment required $Investment in government security 1 $Investment in government security 2 $ Investment in savings for year 1 $Investment in savings for year 2 $Investment in savings for year 3 $Investment in savings for year 4 $Investment in savings for year 5 $Investment in savings for year 6 $B. Use the shadow price to determine how much more Hoxworth should be willing to pay now to reduce the payment at the beginning of year 6 to $400,000. Round your answer to the nearest dollar. ? $C. Use the shadow price to determine how much more Hoxworth should be willing to pay to reduce the year 1 payment to $150,000. Round your answer to the nearest dollar. Hoxworth should be willing to pay anything less than $? .D. Suppose that the annual payments are to be made at the end of each year. Reformulate the model to accommodate this change. Note: All decision variables are expressed in thousands of dollars. If required, round your answers to four decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300) Min ()Fs. t.1)() F +() G1 +() G2 + ()S1 =()2) ()G1 + ()G2 + ()S1 +() S2 = ()3)() G1 +() G2 +() S2 +() S3 =()4)() G1 + ()G2 + ()S3 + ()S4 =()5)() G2 +() S4 + ()S5 =()6) ()S5 + ()S6 =()7) ()S6 + ()S7 =()How much would Hoxworth save if this change could be negotiated? Round your answer to the nearest dollar. $() Do ABCD, For D, answer all ().

Answers: 2

Another question on Business

Business, 21.06.2019 22:30

What is the connection between digital transformation and customer experience

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 17:30

Google started as one of many internet search engines, amazon started as an online book seller, and ebay began as a site where people could sell used personal items in auctions. these firms have grown to be so large and dominant that they are facing antitrust scrutiny from competition regulators in the us and elsewhere. did these online giants grow by fairly beating competition, or did they use unfair advantages? are there any clouds on the horizon for these firms -- could they face diseconomies of scale or diseconomies of scope as they continue to grow? if so, what factors may limit their continued growth?

Answers: 1

Business, 22.06.2019 22:00

Suppose that a paving company produces paved parking spaces (q) using a fixed quantity of land (t) and variable quantities of cement (c) and labor (l). the firm is currently paving 1,000 parking spaces. the firm's cost of cement is $3 comma 600.003,600.00 per acre covered (c) and its cost of labor is $35.0035.00/hour (w). for the quantities of c and l that the firm has chosen, mp subscript upper c baseline equals 60mpc=60 and mp subscript upper l baseline equals 7mpl=7. is this firm minimizing its cost of producing parking spaces?

Answers: 3

You know the right answer?

As part of the settlement for a class action lawsuit, Hoxworth Corporation must provide sufficient c...

Questions

Mathematics, 22.07.2019 04:50

Mathematics, 22.07.2019 04:50