Business, 19.04.2020 23:10 leoisawesome18

On January 1, 2020, Waterway Company purchased 10% bonds having a maturity value of $260,000, for $280,761.26. The bonds provide the bondholders with a 8% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Waterway Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category.

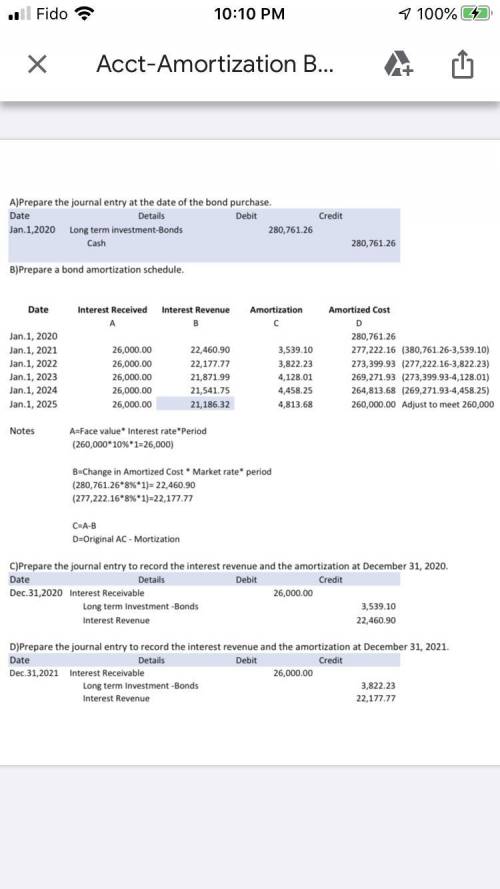

A)Prepare the journal entry at the date of the bond purchase.

B)Prepare a bond amortization schedule.

C)Prepare the journal entry to record the interest revenue and the amortization at December 31, 2020.

D)Prepare the journal entry to record the interest revenue and the amortization at December 31, 2021.

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

Acompany determined that the budgeted cost of producing a product is $30 per unit. on june 1, there were 80,000 units on hand, the sales department budgeted sales of 300,000 units in june, and the company desires to have 120,000 units on hand on june 30. the budgeted cost of goods sold for june would be

Answers: 1

Business, 22.06.2019 03:00

Which of the following is not a consideration when determining your asset allocation

Answers: 3

Business, 22.06.2019 09:30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

You know the right answer?

On January 1, 2020, Waterway Company purchased 10% bonds having a maturity value of $260,000, for $2...

Questions

History, 19.12.2021 06:00

English, 19.12.2021 06:10

Geography, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

English, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

History, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

Computers and Technology, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10

English, 19.12.2021 06:10

Mathematics, 19.12.2021 06:10