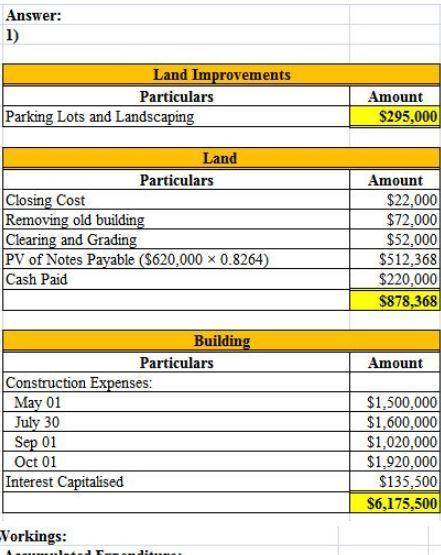

Early in its fiscal year ending December 31.2016. San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased for $840,000 San Antonio paid S220,000 and s*gunned a noninterest bearing note requiring the company to pay the remaining $620,000 on March 28. 2018 An interest rate of 10% properly reflects the time value of money for this type of loan agreement Title search, insurance, and other closing costs totaling $22,000 were paid at closing.

May 1 $1,500,000

July 30 1,600,000

September 1 1,020,000

October 1 1,020,000

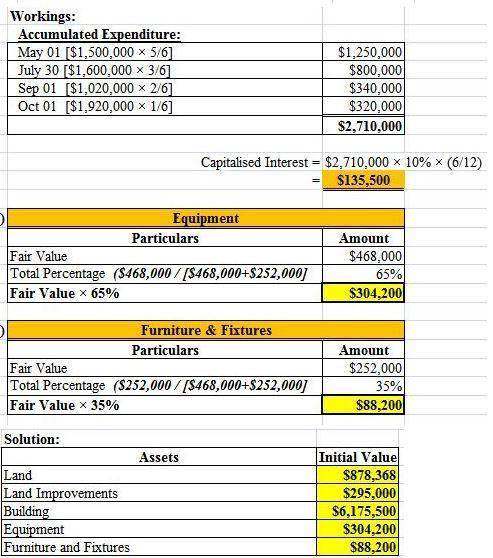

During April, the old building was demolished at a cost of $72,000, and an additional $52,000 was paid to clear and grade the land. Construction of a new budding began on May 1 and was completed on October 29. Construction expenditures were as follows: (VODSL. Pivot(S1. FAD of $1 and PVAD of $1) (Use appropriate factors) from the tables provided.)

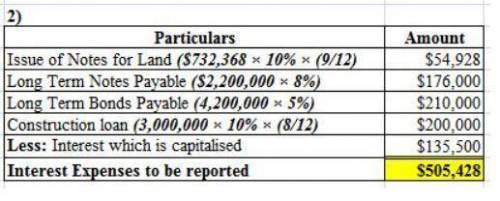

San Antonio borrowed $3,000,000 at 10% on May 1 to help finance construction. This loan, plus interest, will be paid in 2017. The company also had the flowing debt outstanding throughout 2016:

$2,200,000 8% long-term node payable.

$4,200,000 5% long term bonds payable.

In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump-sum price of $620,000. The fair values of the equipment and the furniture and fixtures were $468,000 and $252,000. respectively. In December. San Antonio paid a contractor $295,000 for the construction of parking lots and for landscaping

Required: Determine the initial values of the various assets that San Antonio acquired or constructed during 2016. The company uses the specific interest method to determine the amount of interest capitalized on the building construction.

How much interest expense will San Antonio report in its 2016 income statement?

Answers: 3

Another question on Business

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 22.06.2019 19:00

Which of the following is likely not a benefit of requiring a grand jury to listen to and examine all of the evidence against a person suspected of committing a serious crime and then independently deciding whether or not to hand down an indictment? 1.the grand jury system provides the accused another safeguard against being sent to trial and facing conviction based on flawed evidence. 2.the members of the grand jury are drawn from the community and are empowered to render independent decisions about whether or not the government has collected enough evidence to bring an individual to trial. 3.the grand jury’s decision can provide prosecutors insight into what is necessary to build a sufficient case if a similar crime is presented later. 4.the grand jury is impaneled to rubber-stamp prosecutors’ cases, which makes it possible for more cases to reach trial.

Answers: 2

Business, 22.06.2019 21:20

Suppose life expectancy in years (l) is a function of two inputs, health expenditures (h) and nutrition expenditures (n) in hundreds of dollars per year. the production function is upper l equals ch superscript 0.40 baseline upper n superscript 0.60l=ch0.40n0.60. beginning with c = 1, a health input of $400400 per year (hequals=44) and a nutrition input of $400400 per year (nequals=44), show that the marginal product of health expenditures and the marginal product of nutrition expenditures are both decreasing. the marginal product of health expenditures when h goes from 44 to 55 is nothing, and the marginal product of health when h goes from 66 to 77 is nothing. (round your answers to three decimal places.)

Answers: 2

Business, 22.06.2019 21:30

True or false payroll withholding includes income tax, social security tax, medicare tax as well as money you deduct for your retirement fund.

Answers: 1

You know the right answer?

Early in its fiscal year ending December 31.2016. San Antonio Outfitters finalized plans to expand o...

Questions

Physics, 23.05.2020 01:01

Mathematics, 23.05.2020 01:01

English, 23.05.2020 01:01

Social Studies, 23.05.2020 01:01

Biology, 23.05.2020 01:01

Mathematics, 23.05.2020 01:01