Business, 21.04.2020 01:23 natetheman7740

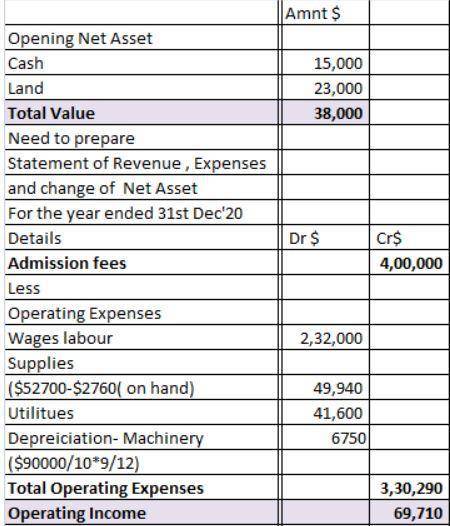

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anchorage Arboretum Authority. The Arboretum Authority is a component unit of the City of Anchorage and must be included in the City's financial statements. It began operations on January 1, 2020 with no outstanding liabilities or commitments and only 2 assets: (1) $15,000 cash and (2) land that it had paid $23,000 to acquire.

Cash Basis

12 months

Cash Receipts:

Admission fees 400,000

Borrowing from bank 80,000

Total deposits 480,000

Cash Disbursements:

Supplies 52,700

Labor 232,000

Utilities 41,600

Purchase of machinery 90,000

Interest on bank note 2,000

Total checks 418,900

Excess of Receipts over Disbursements: 61,100

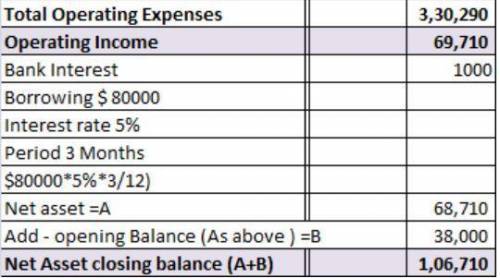

The loan from the bank is dated April 1 and is for a five year period. Interest (5% annual rate) is paid on Oct. 1 and April 1 of each year, beginning October 1, 2020.

The machinery was purchased on April 1 with the proceeds provided by the bank loan and has an estimated useful life of 10 years. (straight-line basis).

Supplies on hand amounted to $2,760 at December 31, 2020. These included $650 of fertilizer that was received on December 29 and paid in January 2020. All other bills and salaries related to 2020 had been paid by close of business on December 31.

Required:

Part A. Prepare a Statement of Revenues, Expenditures and Changes in Fund Balance for the year ended December 31, 2020 for the Arboretum assuming the City plans to account for its activities on the modified accrual basis.

Part B. Prepare a Statement of Revenues, Expenses and Changes in Net Position for the year ended December 31, 2020 for the Arboretum assuming the City plans to account for its activities on the accrual basis.

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 01:00

In order to gauge public opinion about how to handle iran's growing nuclear program, a research group surveyed 1010 americans by telephone and asked them to rate the threat iran's nuclear program poses to the world on a scale of 1 to 10. describe the population, sample, population parameters, and sample statistics. identify the population in the given problem. choose the correct answer below.

Answers: 2

Business, 22.06.2019 07:10

Refer to the payoff matrix. suppose that speedy bike and power bike are the only two bicycle manufacturing firms serving the market. both can choose large or small advertising budgets. is there a nash equilibrium solution to this game?

Answers: 1

Business, 22.06.2019 11:20

Lusk corporation produces and sells 14,300 units of product x each month. the selling price of product x is $25 per unit, and variable expenses are $19 per unit. a study has been made concerning whether product x should be discontinued. the study shows that $72,000 of the $102,000 in monthly fixed expenses charged to product x would not be avoidable even if the product was discontinued. if product x is discontinued, the annual financial advantage (disadvantage) for the company of eliminating this product should be:

Answers: 1

You know the right answer?

The following Statement of Cash Receipts and Disbursements was prepared by the bookkeeper of The Anc...

Questions

Biology, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Biology, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00

Geography, 25.07.2019 08:00

Geography, 25.07.2019 08:00

Mathematics, 25.07.2019 08:00