Business, 21.04.2020 05:15 liquidmana42

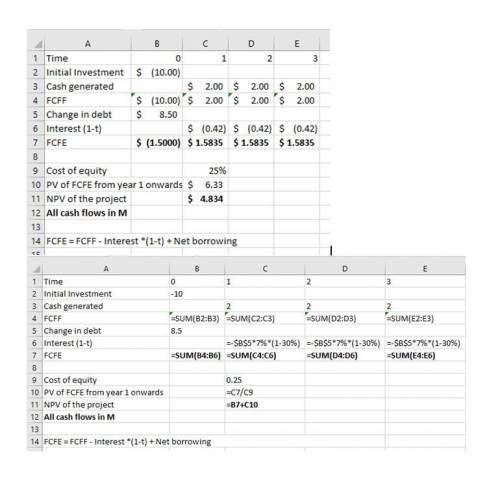

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thinking about expanding into Louisiana. This expansion will require an investment of $10M in free cash flows today, but will generate $2M in free cash flows every year forever. Financing for the expansion will consist of 10% equity and 90% debt. You use CAPM to estimate your cost of equity to be 25%, and this will be stable over time. Your cost of debt, however, is difficult to estimate—your debt consists of deposits, long-term debt, short-term debt, investment grade debt, and debt with different levels of collateral. However, you do know how much your debt will change over time, and the amount of your interest payments. To finance the project, you will issue a total of $8.5M in debt today, and this debt will stay constant. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. Your tax rate is 30%.What is the FCFE at time 0 (i. e. today)? (Hint: Since you just issued the debt, the interest payment at time 0 is simply zero.)A.+$1.5MB.+$1.0MC.-$1.0MD.-$1 .5M

Answers: 1

Another question on Business

Business, 22.06.2019 21:50

Q3. loral corporation manufactures parts for an aircraft company. it uses a computerized numerical controlled (cnc) machining center to produce a specific part that has a design (nominal) target of 1.275 inches with tolerances of ± 0.020 inch. the cnc process that manufactures these parts has a mean of 1.285 inches and a standard deviation of 0.005 inch. compute the process capability ratio and process capability index, and comment on the overall capability of the process to meet the design specifications.

Answers: 1

Business, 22.06.2019 22:10

Asupermarket has been experiencing long lines during peak periods of the day. the problem is noticeably worse on certain days of the week, and the peak periods are sometimes different according to the day of the week. there are usually enough workers on the job to open all cash registers. the problem is knowing when to call some of the workers stocking shelves up to the front to work the checkout counters. how might decision models the supermarket? what data would be needed to develop these models?

Answers: 2

Business, 22.06.2019 23:30

Rate of return douglas keel, a financial analyst for orange industries, wishes to estimate the rate of return for two similar-risk investments, x and y. douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. a year earlier, investment x had a market value of $27 comma 000; and investment y had a market value of $46 comma 000. during the year, investment x generated cash flow of $2 comma 025 and investment y generated cash flow of $ 6 comma 770. the current market values of investments x and y are $28 comma 582 and $46 comma 000, respectively. a. calculate the expected rate of return on investments x and y using the most recent year's data. b. assuming that the two investments are equally risky, which one should douglas recommend? why?

Answers: 1

Business, 23.06.2019 02:30

Arguments made against free trade include all of the following exceptdumping is an unfair trade practice that puts domestic producers of substitute goods at a disadvantage that they should be protected against.national defense considerations justify producing certain goods domestically whether the country has a comparative advantage in their production or not.free trade is inflationary and should be restricted in the domestic interest. if foreign governments subsidize their exports, foreign firms that export are given an unfair advantage that domestic producers should be protected against.infant industries should be protected from free trade so that they may have time to develop and compete on an even basis with older, more established foreign industries.

Answers: 3

You know the right answer?

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thi...

Questions

History, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30

English, 27.06.2019 07:30

History, 27.06.2019 07:30

Biology, 27.06.2019 07:30

History, 27.06.2019 07:30

Mathematics, 27.06.2019 07:30