EX1 ABC Bakery went public by issuing 1,000,000 shares of common stock at $12 per share. The shares are currently trading at $20 per share. Current risk free rate is 6%, market risk premium is 8%, and the company has a beta coefficient of 1.2. During last year, ABC bakery issued 50,000 bonds, the face value of bonds is $1,000 and the bonds are currently trading at $820.

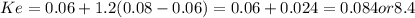

a/ Calculate the cost of equity?

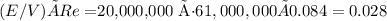

b/ If the tax rate is 34%, the cost of debt is 10%, calculate the weighted average cost of capital?

EX2 :Net Sales Cost of Goods Sold $8,800 Depreciation $500 Tax 20% Selling and Administrative Expense $2,500 Interest Payment $347 Dividend Paid $1,400 (30% of net income)

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Renaldo scanlon is a financial consultant. he earns $30 per hour and works 32.5 hours a week. what is his straight-time pay?

Answers: 1

Business, 22.06.2019 04:50

Problem 9-5. net present value and taxes [lo 1, 2] penguin productions is evaluating a film project. the president of penguin estimates that the film will cost $20,000,000 to produce. in its first year, the film is expected to generate $16,500,000 in net revenue, after which the film will be released to video. video is expected to generate $10,000,000 in net revenue in its first year, $2,500,000 in its second year, and $1,000,000 in its third year. for tax purposes, amortization of the cost of the film will be $12,000,000 in year 1 and $8,000,000 in year 2. the company’s tax rate is 35 percent, and the company requires a 12 percent rate of return on its films. required what is the net present value of the film project? to simplify, assume that all outlays to produce the film occur at time 0. should the company produce the film?

Answers: 2

Business, 22.06.2019 11:00

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 22.06.2019 14:00

Which of the following would not generally be a motive for a firm to hold inventories? a. to decouple or separate parts of the production process b. to provide a stock of goods that will provide a selection for customers c. to take advantage of quantity discounts d. to minimize holding costs e. all of the above are functions of inventory.

Answers: 1

You know the right answer?

EX1 ABC Bakery went public by issuing 1,000,000 shares of common stock at $12 per share. The shares...

Questions

Mathematics, 21.02.2022 08:30

Law, 21.02.2022 08:30

Chemistry, 21.02.2022 08:30

History, 21.02.2022 08:30

Mathematics, 21.02.2022 08:40

Mathematics, 21.02.2022 08:40

Social Studies, 21.02.2022 08:40

Mathematics, 21.02.2022 08:40

Mathematics, 21.02.2022 08:40

Mathematics, 21.02.2022 08:40

Geography, 21.02.2022 08:40