Business, 21.04.2020 18:44 justin5647

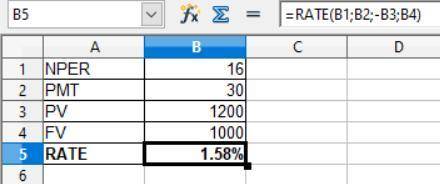

You just purchased a $1,000 par bond with a 6% semi-annual coupon and 15 years to maturity at par. You are hoping that interest rates fall and that you will be able to sell the bond in seven years at a price $1,200. What will the yield to maturity of the bond have to be to get the price you want in seven years

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

What is the most important type of decision that the financial manager makes?

Answers: 2

Business, 21.06.2019 23:30

Acompany is developing a new highperformance wax for cross country ski racing. in order to justify the price marketingwants, the wax needs to be very fast. specifically, the mean time to finish their standard test course should be less thanseconds for a former olympic champion. to test it, the champion will ski the course 8 times. the champion's times(selected at random) are 59.9 61.9 48.8 52.2 46.6 45.3 50.6 and 41.1 seconds to complete the test course. complete parts a and b below.a) should they market the wax? assume the assumptions and conditions for appropriate hypothesis testing are metfor the sample.assume=0.05. what are the null and alternative hypotheses? choose the correct answer below.b) suppose they decide not to market the wax after the test, but it turns out that the wax really does lower the champion'saverage time to less thanseconds. what kind of error have they made? explain the impact to the company of such anerror.

Answers: 2

Business, 22.06.2019 02:50

Grey company holds an overdue note receivable of $800,000 plus recorded accrued interest of $64,000. the effective interest rate is 8%. as the result of a court-imposed settlement on december 31, year 3, grey agreed to the following restructuring arrangement: reduced the principal obligation to $600,000.forgave the $64,000 accrued interest.extended the maturity date to december 31, year 5.annual interest of $40,000 is to be paid to grey on december 31, year 4 and year 5. the present value of the interest and principal payments to be received by grey company discounted for two years at 8% is $585,734. grey does not elect the fair value option for reporting the debt modification. on december 31, year 3, grey would recognize a valuation allowance for impaired loans of

Answers: 3

Business, 22.06.2019 05:00

At which stage would you introduce your product to the market at large? a. development stage b. market testing stage c. commercialization stage d. ideation stage

Answers: 3

You know the right answer?

You just purchased a $1,000 par bond with a 6% semi-annual coupon and 15 years to maturity at par. Y...

Questions

Mathematics, 17.11.2020 23:20

English, 17.11.2020 23:20

Mathematics, 17.11.2020 23:20

Chemistry, 17.11.2020 23:20

Mathematics, 17.11.2020 23:20

History, 17.11.2020 23:20

English, 17.11.2020 23:20

History, 17.11.2020 23:20

Mathematics, 17.11.2020 23:20

French, 17.11.2020 23:20

English, 17.11.2020 23:20