Business, 22.04.2020 01:11 MysteryDove12

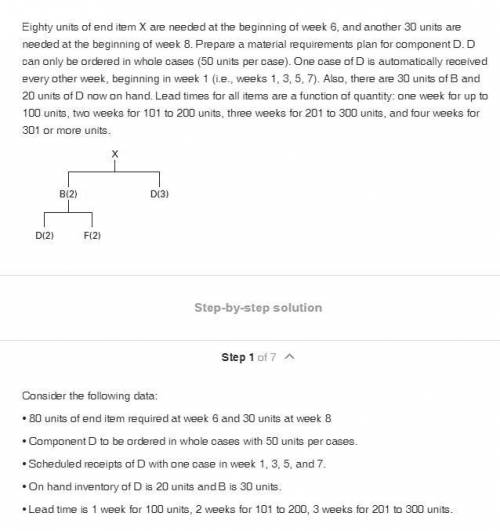

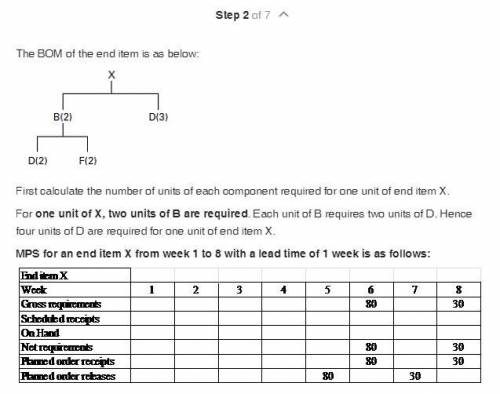

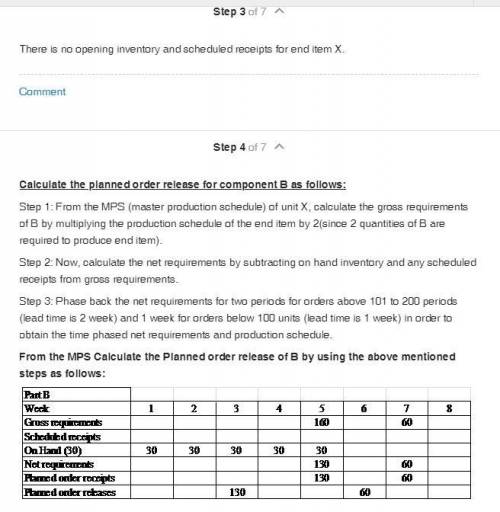

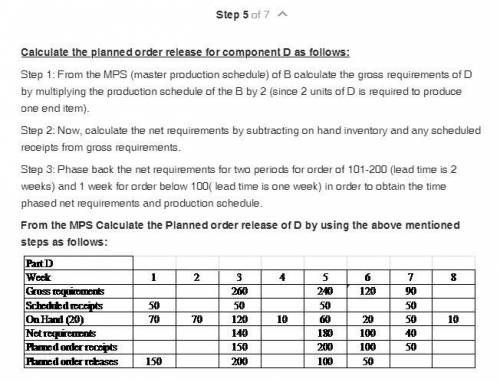

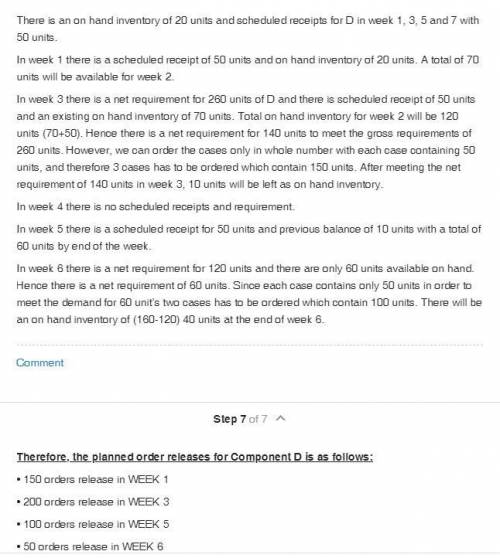

Eighty units of end item X are needed at the beginning of week 6, and another 30 units are needed at the beginning of week 8. Prepare a material requirements plan for component D. D can only be ordered in whole cases (50 units per case). One case of D is automatically received every other week, beginning in week 1 (i. e., weeks 1, 3, 5, 7). Lot-for-lot ordering will be used for all items except D. Also, there are 30 units of B and 20 units of D now on hand. Lead times for all items are a function of quantity: one week for up to 100 units, two weeks for 101 to 200 units, three weeks for 201 to 300 units, and four weeks for 301 or more units.

Answers: 3

Another question on Business

Business, 22.06.2019 07:10

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 10:10

True tomato inc. makes organic ketchup. to promote its products, this firm decided to make bottles in the shape of tomatoes. to accomplish this, true tomato worked with its bottle manufacture to create a set of unique molds for its bottles. which of the following specialized assets does this example demonstrate? (a) site specificity (b) research specificity (c) physical-asset specificity (d) human-asset specificity

Answers: 3

Business, 22.06.2019 10:50

Kimberly has been jonah in preparing his personal income tax forms for a couple of years. jonah's boss recommended kimberly because she had done a good job setting up the company's new accounting system. jonah is very satisfied with kimberly's work and feels that the fees she charges are quite reasonable. kimberly would be classified as a(n) (a) independent auditor (b) private accountant (c) public accountant (d) accounting broker

Answers: 1

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

You know the right answer?

Eighty units of end item X are needed at the beginning of week 6, and another 30 units are needed at...

Questions

Mathematics, 27.10.2020 01:10

Computers and Technology, 27.10.2020 01:10

Physics, 27.10.2020 01:10

Mathematics, 27.10.2020 01:10

Mathematics, 27.10.2020 01:10

History, 27.10.2020 01:10

Health, 27.10.2020 01:10

History, 27.10.2020 01:10

Mathematics, 27.10.2020 01:10

Advanced Placement (AP), 27.10.2020 01:10

History, 27.10.2020 01:10