Business, 22.04.2020 02:31 queenkimm26

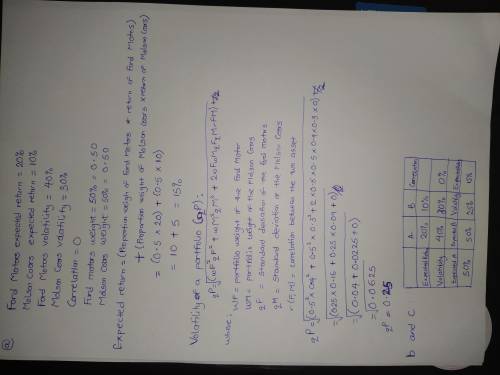

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors Brewing has an expected return of 10 % and a volatility of 30 %. If the two stocks are uncorrelated, a. What is the expected return and volatility of a portfolio consisting of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? b. Given your answer to (a), is investing all of your money in Molson Coors stock an efficient portfolio of these two stocks? c. Is investing all of your money in Ford Motor an efficient portfolio of these two stocks? a. What is the expected return and volatility of a portfolio of 50 % Ford Motor stock and 50 % of Molson Coors Brewing stock? The expected return of the portfolio is

Answers: 2

Another question on Business

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 22:00

Exercise 2-12 cost behavior; high-low method [lo2-3, lo2-4] speedy parcel service operates a fleet of delivery trucks in a large metropolitan area. a careful study by the company’s cost analyst has determined that if a truck is driven 120,000 miles during a year, the average operating cost is 11.6 cents per mile. if a truck is driven only 80,000 miles during a year, the average operating cost increases to 13.6 cents per mile. required: 1.& 2. using the high-low method, estimate the variable and fixed cost elements of the annual cost of truck operation. (round the "variable cost per mile" to 3 decimal places.)

Answers: 3

Business, 22.06.2019 23:30

Sports leave thousands of college athletes with little time for their studies. this is an example of

Answers: 1

Business, 23.06.2019 09:00

Matthew decides to buy expensive designer jeans. less expensive jeans are available, but the added cost of the designer brand is worth it to matthew most likely because

Answers: 1

You know the right answer?

Suppose Ford Motor stock has an expected return of 20 % and a volatility of 40 %, and Molson Coors B...

Questions

English, 10.07.2019 16:40

Social Studies, 10.07.2019 16:40

History, 10.07.2019 16:40

Mathematics, 10.07.2019 16:40

English, 10.07.2019 16:40

Biology, 10.07.2019 16:40

Biology, 10.07.2019 16:40

Biology, 10.07.2019 16:40

Chemistry, 10.07.2019 16:40